Juphy’s Weekly E-Commerce News Express – 12-16 May 2025

Ceyda Duz

Welcome to your weekly pulse on the ever-evolving world of e-commerce and AI! This week, we take a closer look at the turbulent waters of TikTok Shop in the US as it navigates the complexities of newly implemented tariffs. We also analyze the potential shift in the retail landscape, questioning if the era of e-commerce disruption is truly over and examining the enduring strength of brick-and-mortar stores.

Beyond these insights, we’ll briefly cover new product updates from big players such as eBay, Fluent, Rebuy, and Shopify. Stay informed as we navigate these crucial developments and more, providing you with the insights you need!

Early indicators suggest a cooling trend in TikTok Shop’s US sales momentum, largely attributed to newly implemented tariffs impacting international sellers, predominantly in China. This shift coincides with similar strategic adjustments being made by e-commerce rivals like Temu and Shein in response to the changing US trade landscape.

Impact of Tariffs on Sales and Seller Sentiment

TikTok Shop has experienced a noticeable dip in daily US sales from its foreign merchants since late March, with a significant 20-25% month-over-month decrease observed in early May. This decline is strongly correlated with notable tariff increases on specific Chinese products, which increased to over 145% in April. Internal data confirms this trend, showing a decrease in gross merchandise volume (GMV) after an initial rise, thereby challenging earlier projections for consistent growth. Consequently, sellers are expressing increased anxiety due to the complexities of tariffs introduced into pricing and logistical planning, driven by rising costs and market uncertainty.

The escalating cost of sourcing Chinese goods, a cornerstone of TikTok’s global e-commerce strategy, presents a significant hurdle for its sellers. Although some of the initial tariff hikes have been temporarily eased, the initial shockwaves and the removal of the de unimportant exemption have created considerable instability within the supply chain. This disruption extends beyond TikTok Shop, impacting US businesses reliant on Chinese manufacturing and prompting platforms like Shein and Temu, which previously benefited from tariff exemptions, to reassess their operational models.

Strategic Response Amidst Regulatory Uncertainty

This period of e-commerce turbulence for TikTok Shop unfolds against a backdrop of broader regulatory uncertainties for the platform within the United States. Despite these widespread challenges, e-commerce remains a strategically vital area of focus for TikTok globally, drawing inspiration from the proven success of its sister application, Douyin, in the Chinese market. Recent adjustments in the leadership structure of TikTok’s e-commerce division signal a clear intent to leverage successful strategies and expertise to effectively navigate the complexities of the US market.

Ultimately, the near-term course of TikTok Shop in the US market will likely be significantly determined by the ongoing effects of these tariffs and the platform’s capacity to adapt its operational strategies and provide effective support to its seller community throughout this period of economic transition.

Is Retail’s E-Commerce Shake-Up Truly Over?

A recent report from Colliers, a commercial real estate firm, suggests a noteworthy shift in the retail landscape: the era of e-commerce as a disruptive force may be largely behind us. The report, published on May 12, 2025, highlights the enduring dominance of brick-and-mortar stores in driving core retail sales, a trend that is projected to continue.

The Resilience of Brick-and-Mortar

- Consistent In-Store Sales: Over the past 15 years, the value of in-store sales has only experienced a single decline, during the pandemic lockdowns of 2020.

- Dominant Share: Physical stores currently account for over 76% of core retail sales. While e-commerce continues to grow, its once-rapid pace has moderated.

- Essential Channel for D2C: Direct-to-consumer brands, even those once highly valued, now recognize physical stores as a critical sales channel, whether through their own outlets or wholesale partnerships.

The Evolved Role of E-Commerce

- Omnichannel Integration: Traditional retailers have successfully established their own e-commerce operations. Consumers now expect seamless online and offline purchasing and returns, often giving retailers with physical stores an advantage.

- Store-Assisted Online Sales: In 2024, physical stores played a crucial role in approximately one-third of online retail sales through options like in-store pickup or ship-from-store, a milestone reached earlier than anticipated. This is projected to rise further.

- Returns Management: Stores have become a vital channel for handling the increasing volume of returns associated with e-commerce. Retailers are strategizing on whether to manage these in-house, outsource, or adopt a hybrid approach.

Store Closures: Not Necessarily E-Commerce Driven

While numerous store closures have occurred in recent years, particularly due to bankruptcies, the Colliers report suggests these are primarily linked to operational challenges or market saturation rather than direct displacement by e-commerce. Interestingly, new players, including international brands, are actively seeking physical store locations, and some previously closed stores are reopening under new ownership.

The Evolving Brick-and-Mortar Experience

The role of physical stores is evolving beyond mere transactions. Retailers are increasingly investing in experiential elements, improved store design, and digital tools within their physical spaces to foster customer loyalty and drive conversions. This reimagined in-store experience is becoming an integral part of a good omnichannel strategy to meet rising consumer expectations across all touchpoints.

Despite the apparent stabilization against e-commerce disruption, retailers still face challenges, particularly from tariffs potentially leading to higher costs and price-sensitive consumers. Looking ahead, retailers may explore revenue streams beyond traditional retail to strengthen their financial performance. The retail landscape remains dynamic, requiring retailers to remain adaptable to developing market conditions.

Fluent and Rebuy Unite to Offer Post-Purchase Advertising for Shopify Stores

Fluent, a commerce media solutions provider, and Rebuy, an e-commerce personalization platform tailored for Shopify brands, have announced a collaboration to introduce Rebuy Ads powered by Fluent. This new offering aims to empower Shopify merchants to deepen customer engagement and unlock supplementary revenue streams without incurring additional costs. The partnership strategically combines Fluent’s AI-driven advertiser marketplace and demand-generation capabilities with Rebuy’s seamless Shopify integration and extensive partner network, creating a novel avenue for post-purchase marketing and monetization.

eBay Backs Open-Box Buys with New Warranty Program

eBay is strengthening buyer confidence in pre-owned goods with the launch of a warranty program for open-box items within its Electronics and Home categories. Qualifying listings will now prominently feature a “Certified Open Box” badge, signaling adherence to key service standards, including free shipping and returns. Notably, each Certified Open Box product will come with a one-year warranty, serviced by Allstate Protection Plans. This initiative aims to reduce buyer hesitation and further tap into the growing market for value-conscious consumers seeking quality merchandise at a discount. By offering this added layer of protection, eBay is striving to create a more secure and appealing marketplace for both buyers and sellers of open-box goods.

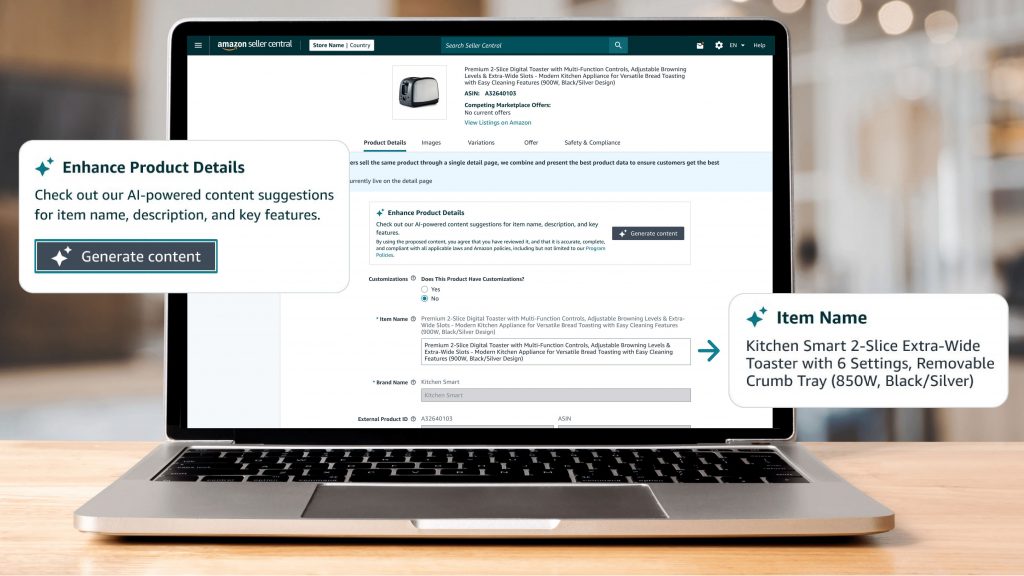

Amazon Empowers Sellers with AI-Driven Listing Optimization

Amazon has introduced “Enhance My Listing“, a new generative AI tool designed to help sellers automatically refine and maintain their product listings. This innovative feature provides timely and relevant recommendations for key elements such as product titles, attributes, descriptions, and missing information. Sellers retain full control, with the ability to review, customize, or reject these AI-powered suggestions. By combining the efficiency of AI with seller expertise, Amazon aims to streamline listing optimization, ensuring products are presented with comprehensive details and compelling language to enhance discoverability and drive sales.

Speaking Your Customer’s Language with Juphy AI

As platforms like TikTok Shop face rising challenges from shifting trade policies and global seller logistics, one thing is certain: effective communication across borders is now a competitive advantage. Whether your customers are in the US, Europe, or beyond, they expect fast, accurate answers—in their own language. That’s where Juphy AI steps in.

With its multilanguage support with automatic detection, enabling your AI assistant to seamlessly understand and respond in 98+ languages. From pre-purchase product questions to post-purchase support, Juphy ensures every interaction feels native and natural—without adding pressure on your team.

This isn’t just translation—it’s intelligent, real-time multilingual engagement, designed to help your Shopify store scale globally without compromising on customer experience. Whether you’re responding to a customer in Spanish at noon or in German at midnight, Juphy has it covered.

Start speaking your customers’ language—literally. Try Juphy AI for free!

Key Takeaways

TikTok Shop Faces Headwinds from Tariffs: TikTok Shop’s momentum in the US has recently slowed, with a reported 20–25% dip in daily sales among international sellers—mainly from China—since late March. The downturn is closely tied to newly imposed tariffs, some of which surged past 145%, and the removal of the de minimis exemption.

Is E-Commerce Still Disrupting Retail?: A new report by Colliers suggests that e-commerce’s role as a retail disruptor may have peaked. Despite its continued growth, brick-and-mortar stores remain dominant, accounting for over 76% of core retail sales. In fact, physical stores are becoming more valuable, with many D2C brands now relying on them for distribution and consumer engagement.

Fluent & Rebuy for Post-Purchase Ads: Fluent and Rebuy have partnered to introduce a new post-purchase ad solution for Shopify merchants. Powered by Fluent’s commerce media technology and Rebuy’s personalization engine, the new Rebuy Ads feature allows brands to display highly targeted advertisements after checkout.

eBay’s Open-Box Warrenty: To increase trust in its pre-owned marketplace, eBay has launched a Certified Open Box program, complete with one-year warranties backed by Allstate Protection Plans. Eligible electronics and home goods listings will now feature a certification badge, along with free shipping and returns.

Amazon’s AI Tool for Product Listings: Amazon’s latest generative AI feature, Enhance My Listing, helps sellers automatically optimize product titles, descriptions, and attributes. The tool provides real-time suggestions to improve clarity, relevance, and discoverability—while still allowing sellers full control to edit or reject AI-generated content.