Juphy’s Weekly E-Commerce News Express – 07-11 October 2024

Ceyda Duz

Stay ahead of the curve with all the key e-commerce highlights you might have missed! From Amazon Prime Big Deal Days 2024 to holiday spending trends as consumers gear up for a price-conscious season, we’ve got you covered. Plus, get the scoop on the latest product updates from Pinterest, eBay, and Google. Dive in to catch up on the trends shaping the industry!

Amazon Prime Big Deal Days 2024 Sees Strong Performance

Momentum Commerce, a consulting firm managing Amazon sales for brands totaling over $7 billion in annual marketplace sales, reported a notable 41% year-over-year growth for its clients during Day 1 of Amazon’s Prime Big Deal Days 2024. This October event, originally introduced in 2022 as a second major sales event alongside Prime Day, continues to draw significant consumer interest, with this year’s edition taking place on October 8 and 9.

Although Day 1 sales still followed the summer Prime Day by 34%, the gap between the two events has shrunk compared to previous years, signaling the growing importance of Prime Big Deal Days as a key sales event on the Amazon calendar.

Interestingly, consumer buying behavior showed a shift compared to last year’s event, with peak sales happening later in the day – at 8 p.m. Central – rather than during the morning. This change in purchasing patterns highlights evolving shopper habits with consumers preferring to shop after office hours.

While Amazon itself experienced solid performance, external factors affected overall e-commerce growth. Data from Salesforce revealed that online traffic in the U.S. was down 4% and online orders were down 5%, partly due to severe weather events impacting certain regions. However, Canadian and European retailers saw modest growth in traffic and orders during Day 1, with Food & Beverage, Health & Beauty, and Handbags showing strong performance globally.

As the event continued into Day 2, Momentum Commerce noted a 42% sales increase as of midday, indicating that the overall results for the two-day event may be closely matched, a trend that varies from previous years where Day 2 typically saw softer sales.

With growing consumer engagement and improved sales figures, Prime Big Deal Days is firming its place as a critical event for online brands preparing for the holiday shopping season.

Holiday Spending Trends: Consumers Prepare for a Price-Sensitive Season

Despite the calendar still showing October, consumers are already thinking ahead to their holiday shopping plans. A recent survey by ESW revealed that 61% of respondents plan to spend more than $600 this season, up from 48% last year. However, the rising costs of essentials like food and fuel are causing some shoppers to tighten their budgets, with 47% of those cutting back attributing it to these higher expenses.

With consumers feeling the pressure from increased prices, the financial strain is not preventing everyone – 37% of shoppers have already started preparing for the holiday rush, and key shopping events like Amazon Prime Deal Days, Black Friday, and Cyber Monday are expected to dominate consumer spending.

Especially, Black Friday remains the event where consumers plan to spend the most, driven by the search for deals and value. It seems like while economic uncertainty dominates, shoppers are still keen to spend more, with price and value being top priorities.

Online shopping will see continued growth, presenting retailers with opportunities to capture more customers, sales, and market share. Data shows that 43% of consumers expect to shop online more this holiday season, emphasizing the importance of a smooth e-commerce experience. Retailers will need to focus on offering free shipping and returns as standard, as well as creating enticing promotions like product bundles and gifts-with-purchase to meet consumer expectations.

In terms of product categories, beauty is anticipated to resonate strongly with holiday shoppers, while private-label brands may see increased traction due to price sensitivity. Retailers are encouraged to adopt a localized approach to inventory management, ensuring they offer the right products, sizes, and deals to match demand across different regions, both domestically and internationally.

Additionally, platforms like TikTok may play a smaller role in direct shopping for some demographics, but they remain a key source of inspiration for younger consumers, particularly Gen Z and millennials. Retailers that prioritize omnichannel strategies and tailor promotions to these shifting preferences are likely to thrive in the months ahead.

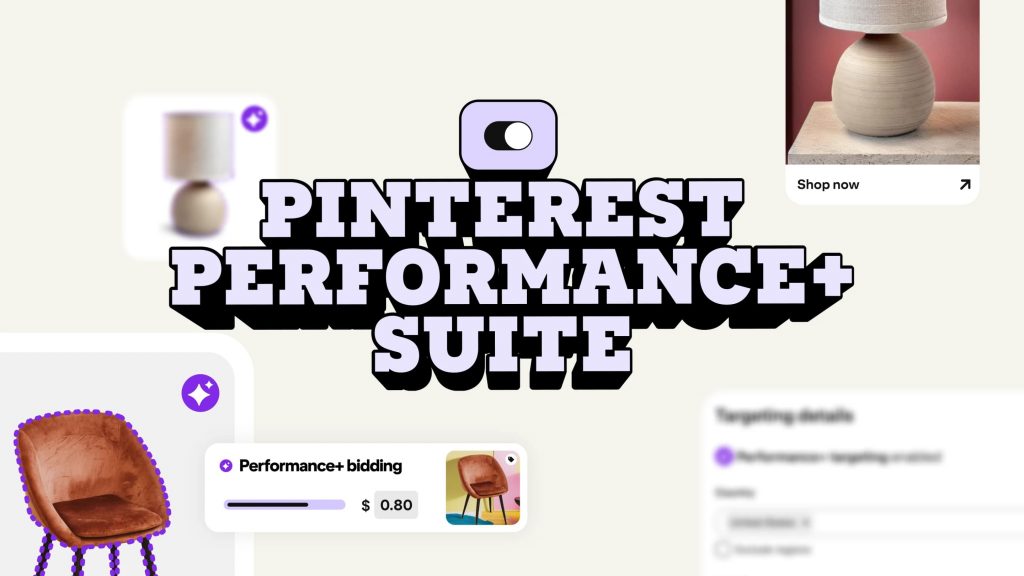

Pinterest’s AI Tools and Automation for Advertisers

Pinterest has rolled out its new Performance+ suite, designed to give advertisers more powerful tools for driving campaign results. This suite focuses on boosting consideration, conversions, and catalog sales, utilizing AI to streamline the process. One standout feature is the ability to use generative AI to transform simple product images into engaging lifestyle visuals. The platform has also updated its search and home feeds with more personalized promotions and deal-focused ad modules, aiming to offer advertisers better opportunities to reach their target audiences effectively

eBay U.K. Eliminates Fees for Private Sellers

eBay U.K. is making it easier for private sellers by removing selling fees across all categories, excluding motors. This change means sellers will no longer pay final value or regulatory fees. Along with this, eBay has introduced AI-generated descriptions and tools to enhance product photos, helping users list items more efficiently. Additionally, starting in mid-October, sellers will be able to use their earnings through eBay Balance, which can be applied to shopping, promoting listings, purchasing labels, or cash withdrawals.

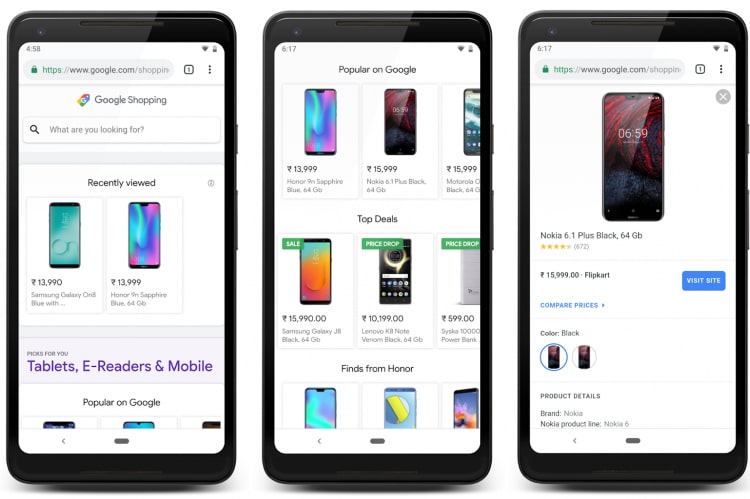

Google Lens Expands with Shopping Ads and Enhanced Features

Google Lens now offers shopping ads integrated into its visual search results, allowing users to see relevant ads alongside the usual product images. The updated tool also provides a detailed results page, showcasing product reviews, price comparisons, and purchasing options. In addition, Lens has added new functionality, enabling users to search using videos or voice queries, making the visual search experience even more interactive and convenient.

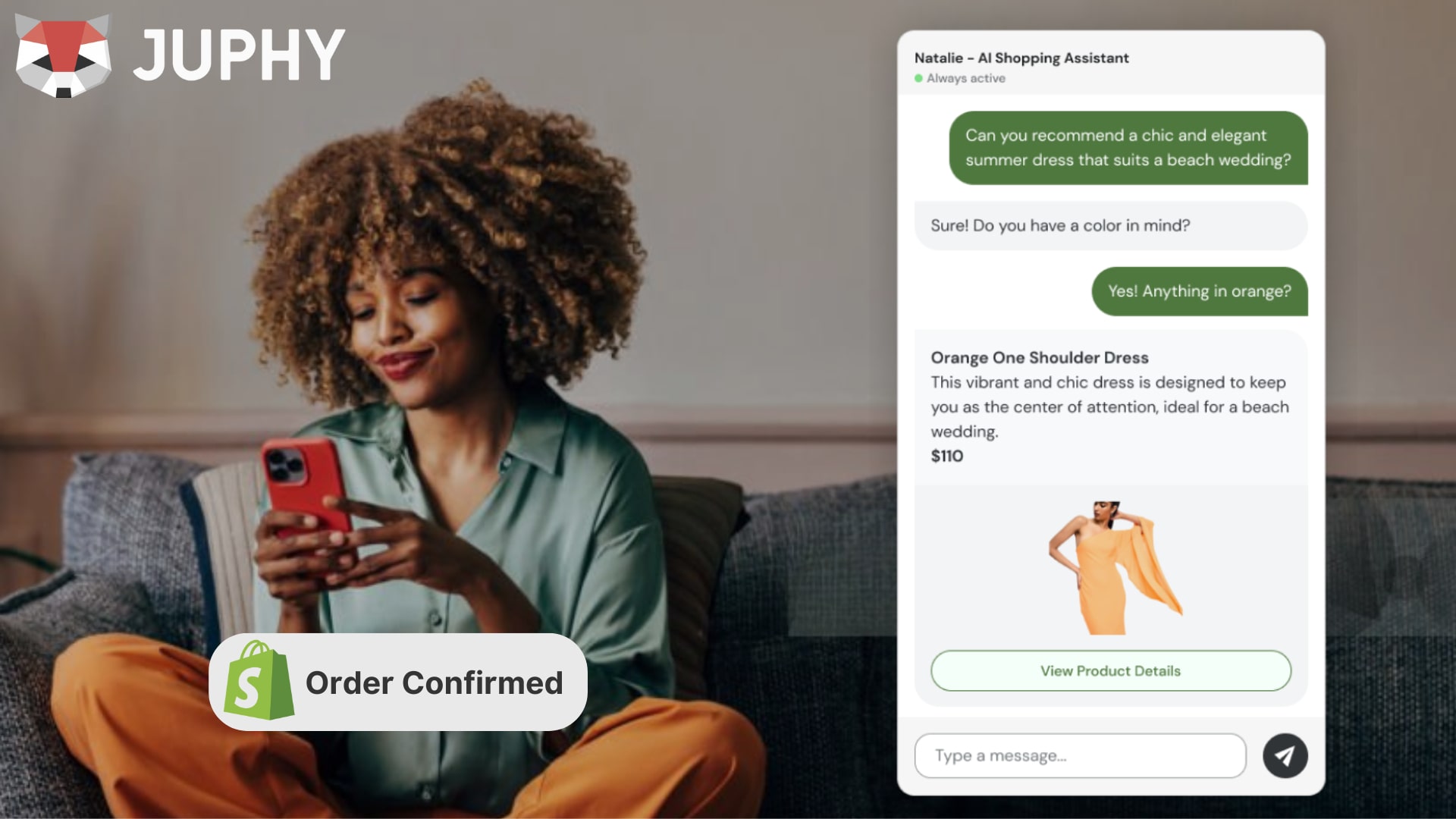

Juphy AI’s Big Impact on Holiday Shopping

As we approach this year’s holiday shopping season, consumers are gearing up for their gift searches and purchases. Recent trends, such as the Amazon Prime Big Deal Days, highlight that today’s shoppers don’t just browse during office hours – they’re making purchases late at night. This shift makes it challenging to capture those late-night sales when your online store lacks assistance and guidance to convert browsers into buyers.

Meet Juphy’s AI Agent! With Juphy AI, you can seize every sales opportunity, day or night, even during the holidays. It serves as a highly capable sales representative, eliminating the need to hire an entire sales team. Specifically designed for Shopify stores, Juphy’s AI Agent assists customers in educating and guiding customers through various queries – from product-specific questions to order tracking, return policies, shipping inquiries, and more – while increasing your Shopify sales. Transform your customers’ pre- and post-sale journeys into memorable and enjoyable experiences with instant assistance and attentiveness.

Don’t let sales slip away! Try Juphy AI today and enjoy a hassle-free holiday season like never before: apps.shopify.com/juphy

Key Takeaways

Amazon Prime Big Deal Days 2024: Momentum Commerce reported a 41% year-over-year sales growth for its clients during Day 1 of Amazon’s Prime Big Deal Days 2024. Despite trailing the summer Prime Day by 34%, the gap between the two events is shrinking. Consumer behavior has shifted, with peak sales occurring later in the day at 8 p.m. Central.

Holiday Spending Trends: Rising costs of essentials are leading 47% of shoppers to cut back on holiday spending, but a survey reveals that 61% of respondents still plan to spend more than $600 this season. Black Friday remains the top event for finding deals, with online shopping continuing to grow in popularity.

Pinterest’s AI and Automation Tools: Pinterest’s new Performance+ suite offers advanced AI tools to help advertisers boost campaign performance, including using generative AI to create lifestyle visuals from simple product images. Updated search and home feeds also enhance ad targeting with personalized promotions.

eBay U.K. Eliminates Fees for Private Sellers: eBay U.K. is now free for private sellers across all categories, excluding motors, eliminating final value and regulatory fees. AI-generated descriptions and enhanced product photo tools make listing more efficient, while sellers can now use their eBay Balance for shopping and promoting listings.

Google Lens Expands with Shopping Ads: Google Lens now integrates shopping ads into visual search results, offering detailed pages with product reviews, price comparisons, and purchasing options. New features allow users to search via video or voice, enhancing the interactive shopping experience.