Juphy’s Weekly E-Commerce News Express – 17-21 March 2025

Ceyda Duz

In this week’s e-commerce news roundup, we dive into the latest trends reshaping the retail landscape—from the increase in AI-powered shopping traffic to the mixed performance in February’s retail numbers. Discover how AI is driving engagement and increasing conversions while reshaping consumer behavior and pushing retailers to adapt. We’ll also cover updates from Amazon, Knowband’s mobile app builder, and a partnership between eHub & Osa Commerce. Read on to stay ahead of these game-changing developments!

AI-Powered Traffic to E-Commerce Sites: What Retailers Need to Know

The role of generative AI in e-commerce is growing at an outstanding rate. According to the latest Adobe Analytics report, traffic from AI-powered sources to U.S. e-commerce websites increased by 1,200% in February, compared to six months ago. The trend is advanced, with AI-driven visits doubling every two months since September.

AI’s Growing Influence on Online Shopping

- During the 2024 holiday season, traffic from AI chatbots rose by 1,300%, with Cyber Monday alone seeing a 1,950% increase.

- Despite traditional channels like paid search and email still leading in overall traffic, the rapid rise of AI-driven engagement marks a shift in consumer behavior.

Major retailers are adapting quickly—at the National Retail Federation conference in January, AI was a primary focus, with 97% of retail professionals planning to increase AI investments.

Higher Engagement & Evolving Consumer Behavior

Consumers interacting with AI-driven platforms are showing stronger engagement compared to visitors from other channels:

- 8% higher engagement – AI-assisted visitors spend more time on websites.

- 12% more pages per session – Shoppers browse deeper into product catalogs.

- 23% lower bounce rate – Fewer visitors leave after viewing just one page.

Shoppers are increasingly using generative AI for:

- Product research (55%)

- Personalized recommendations (47%)

- Finding discounts and deals (43%)

- Gift ideas and shopping list creation (35%)

AI-Driven Purchases Are on the Rise

While AI-generated traffic was initially less likely to result in purchases, that gap is closing fast. Compared to July 2024, AI-driven visitors are now 9% less likely to convert than other sources—down from 43% less likely just months ago.

- Apparel, home goods, and grocery still lag in conversion rates.

- Electronics & jewelry lead in AI-assisted purchases.

More, travel and financial services are seeing explosive AI-driven growth, with traffic up 1,700% for travel sites and 1,200% for banking platforms since mid-2024.

What This Means for E-Commerce Brands

- Adapting to AI-driven traffic is no longer optional—shoppers are actively seeking AI assistance for better purchasing decisions.

- Retailers investing in AI-powered chatbots and recommendation engines can improve engagement, reduce bounce rates, and drive higher conversions.

- AI-powered personalization is a key differentiator in an increasingly competitive market.

The data is clear: AI is shaping the future of e-commerce, and businesses that embrace it will stay ahead of the curve.

February Retail Performance: A Mixed Bag for U.S. Consumer Spending

February’s retail performance data is a complex story, with numbers showing mixed results. The seasonally adjusted figures indicate a modest 0.2% increase from January and a 3.1% rise compared to February 2024. However, when adjusted for inflation and considering year-over-year trends, retail sales fell by 0.9% and declined by 4% month-to-month in unadjusted figures. This mixed data paints a challenging picture for understanding the current retail landscape.

Key Retail Facts: February 2025 Sales

- Total retail and food services revenue reached $639.1 billion in February, down from $644.8 billion the previous year.

- Seasonally adjusted retail sales stood at $722.7 billion, an increase from $700.9 billion in February 2024.

Sector Performance: What’s Up and What’s Down?

While some sectors reported declines, others showed promising growth:

Declines:

- Automobiles: 1% to $125.4 billion

- Food services & drinking places: 2% to $87.3 billion

- Gas stations: 4% to $45.3 billion

- Building materials: -6% to $31.9 billion

- Clothing stores: 3% to $21.3 billion

Growth:

- Non-store retail (e-commerce): +2% to $111.2 billion

- Health and personal care stores: +2% to $34.5 billion

- Furniture & home furnishings: +2% to $10.5 billion

Flat performance:

- Food & beverage stores: $77.1 billion

- General merchandisers: $67.3 billion

Seasonal Adjustments: A Double-Edged Sword

The Census Bureau’s seasonal adjustments, which account for holidays and trading days, often obscure the true picture of retail performance. In February 2025, the industry generated an average of $22.8 billion per trading day, a 3% increase over February 2024, indicating that consumers spent more per day, roughly aligned with inflation.

However, the use of seasonally adjusted numbers complicates the understanding of month-over-month trends, especially since holidays heavily influence consumer spending, as seen in the strong December retail season.

Consumer Sentiment: A Decline in Confidence

Consumer sentiment took a hit in March. This decline reflects growing concerns about inflation and the impact of political and economic factors, such as Trump administration tariffs. Despite this dip, the National Retail Federation (NRF) reassured the industry that consumer fundamentals remain stable, with healthy job growth and low unemployment continuing to support spending.

Looking Ahead: Seasonal Trends and Easter’s Impact

With Easter falling later this year (on April 20 compared to March 31, 2024), retailers in apparel, home goods, and general merchandise may see an uptick in sales, especially in outdoor and seasonal items. Last year, the NRF estimated $22.4 billion in Easter-related spending, and while the 2025 forecast is yet to be released, a later Easter could give spring fashion retailers an unexpected increase.

What Retailers Should Watch

- Keep a close eye on consumer sentiment, as inflation concerns could affect future spending.

- Focus on seasonal trends to maximize sales, especially with later spring and Easter spending.

- Monitor the ongoing shift to non-store retail as e-commerce continues to grow, now a $111.2 billion sector.

In summary, February’s retail performance paints a picture of cautious optimism. Retailers must adapt to the shifting consumer landscape, especially as AI, inflation, and seasonal changes continue to influence the market.

Amazon’s Personalized Restock Recommendations: Streamlining Inventory Management

Amazon has introduced a new feature in Seller Central to help merchants optimize their inventory levels. Through a demand forecasting model, Amazon now provides personalized restock recommendations to sellers for their Fulfilled by Merchant (FBM) listings. This model calculates suggested restock quantities and dates based on key factors, including active sales, projected demand, and days of supply being less than 14. Sellers can easily access these insights by navigating to the Manage Inventory page and clicking on the Restock notification in the Inventory column. This feature allows merchants to maintain healthier inventory levels, improve stock availability, and minimize lost sales.

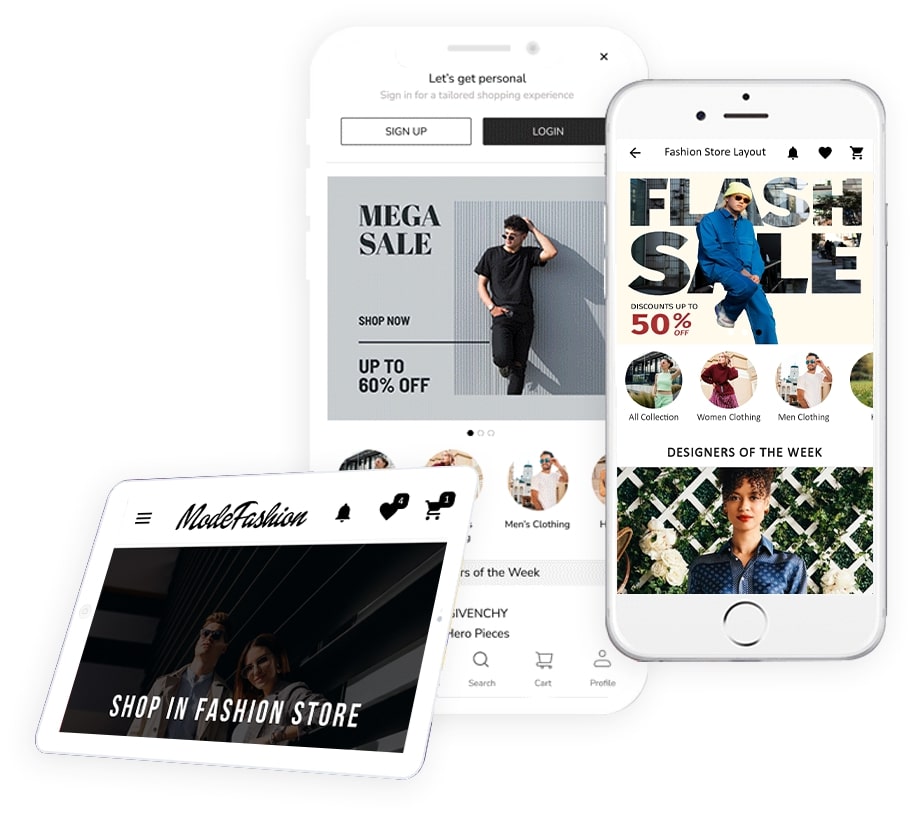

Knowband’s Mobile App Builder for E-Commerce Sales

Knowband, known for providing plugins and add-ons for e-commerce platforms like WooCommerce, and Magento, has launched a new mobile app builder aimed at enhancing online store sales. The solution comes with a range of features designed to improve the shopping experience, including dynamic product catalogs, multi-language and multi-currency support, a customizable tab bar layout, and an intuitive drag-and-drop editor. This mobile app builder allows merchants to easily create and manage mobile apps for their stores, helping them reach customers on mobile devices and drive more sales.

eHub & Osa Commerce for Streamlined Logistics and Fulfillment

eHub, a provider of e-commerce logistics and shipping services, has partnered with Osa Commerce, a unified commerce and operations software provider, to enhance supply chain and fulfillment management for businesses. The collaboration integrates eHub’s shipping API and rate optimization tools with Osa Commerce’s platform, which unifies fragmented data across e-commerce platforms, warehouses, and marketplaces. This integration allows businesses to manage their entire fulfillment process from a single platform, simplifying operations and improving efficiency.

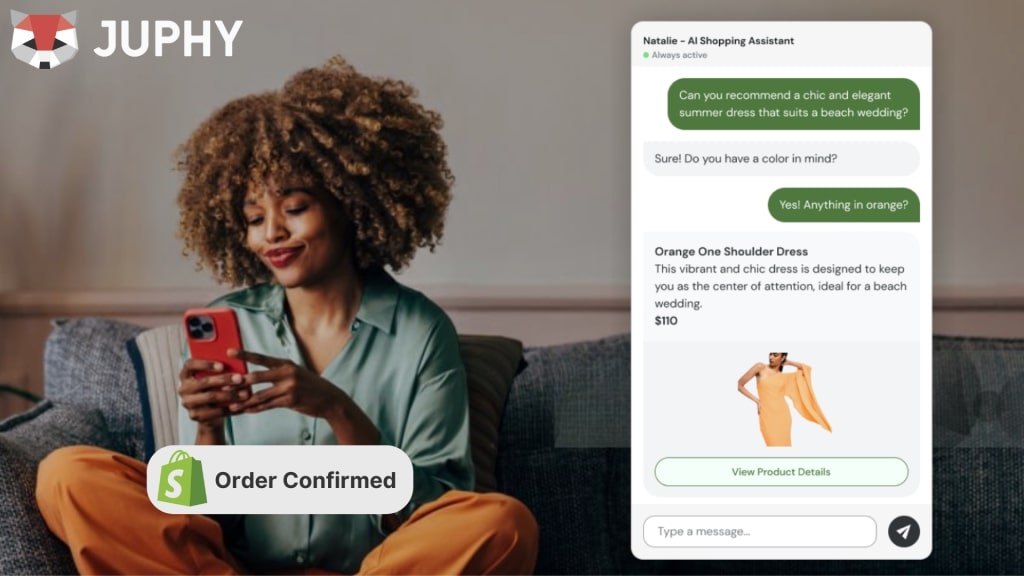

How Juphy Can Help You Capitalize on AI-Driven Traffic

With AI-powered traffic on the rise and gaining popularity, it’s essential for retailers to tap into this new wave of shopper behavior. Juphy’s AI Agent and its Smart Product Recommender are here to make that easy. It lets Shopify merchants engage AI-driven visitors by delivering personalized product recommendations in real-time based on their browsing history, preferences, and interests. As shoppers increasingly turn to AI for tailored suggestions, Juphy’s AI Agent ensures your visitors see the products they’re most likely to buy, improving both engagement and conversion rates. Ready to turn more AI-driven traffic into loyal customers and raise your sales? Try Juphy AI today: apps.shopify.com/juphy

Key Takeaways

AI-Powered Traffic to E-Commerce Sites: AI-generated traffic to e-commerce sites has surged by 1,200%, with a consistent increase every two months since September. AI-driven visitors show higher engagement, spend more time on websites, and browse deeper, which helps reduce bounce rates.

February Retail Performance: February’s retail sales showed mixed results, with e-commerce growing by 2% while traditional sectors like automobiles and clothing experienced declines. Retailers should leverage seasonal trends like Easter and focus on the ongoing shift to e-commerce for better results.

Amazon’s Personalized Restock Recommendations: Amazon has introduced personalized restock recommendations for sellers, helping them optimize inventory levels and reduce lost sales. The feature uses demand forecasting to suggest restock quantities and dates, ensuring stock availability for popular products.

Knowband’s Mobile App Builder: Knowband’s new mobile app builder enables merchants to create customized mobile apps for their stores on platforms like PrestaShop and Magento. The builder includes features like dynamic product catalogs, multi-language support, and drag-and-drop customization.

eHub & Osa Commerce: eHub has partnered with Osa Commerce to simplify e-commerce logistics and fulfillment by integrating shipping and rate optimization tools with Osa’s platform. This collaboration allows businesses to manage their entire fulfillment process from one system, improving operational efficiency and reducing complexities.