Juphy’s Weekly E-Commerce News Express – 28 October-01 November 2024

Ceyda Duz

In this week’s e-commerce and AI news highlights, explore Shopify’s new comprehensive financial suite tailored for e-commerce entrepreneurs. Discover how retailers are preparing for a successful holiday season and stay updated on the latest product announcements from Optimize.ai, PayPal, Global Payments, and Amazon. Stay informed during the holiday rush with the trends and innovations shaping the future of retail, online shopping, and AI technology.

Shopify Launches Financial Suite for E-Commerce Entrepreneurs

To address the needs of e-commerce entrepreneurs who often find themselves overlooked by traditional banks, Shopify has announced a strategic collaboration with financial companies to introduce a comprehensive financial suite. This new offering includes essential services such as capital funding, commercial credit cards, sales tax management, and a bill-pay system, all designed to empower entrepreneurs in their business journeys.

A recent Shopify-Gallup survey of nearly 47,000 entrepreneurs revealed that 40% cited financial risk as a significant barrier to starting their businesses. Recognizing this challenge, Shopify aims to change the financial landscape for entrepreneurs. With the introduction of the Shopify Finance product suite, the company is committed to transforming the financial opportunities available to startups.

Key Components of the Shopify Finance Suite:

- Shopify Capital: This service provides eligible merchants access to up to $2 million in fast funding, regardless of business size or financial history. Importantly, there are no credit checks, and it does not impact personal credit scores. Shopify is also rolling out “monthly loan-cost structures” that lower overall repayment costs for merchants who choose to expedite their payments, offering greater flexibility tailored to individual business needs.

- Shopify Credit: This is a “pay-in-full” Visa business card that rewards merchants with up to 3% cash back on qualified purchases related to marketing, wholesale, and fulfillment. Merchants can choose between paying the full statement balance within a month or spreading payments over time, offering up to 10 months for repayment based on a percentage of sales.

- Shopify Balance: This free business account allows merchants to receive payments before the next business day and includes a 3.39% annual percentage yield (APY) on funds. For merchants on the Shopify Plus plan, the APY reward increases to 4.43%, along with higher ACH financial transfer limits and default next-day payouts.

- Shopify Tax: This tool automates the filing and remittance of sales tax returns for eligible merchants. It can also set aside sales tax funds into a Shopify Balance account, ensuring merchants are prepared to meet their tax obligations.

- Shopify Bill Pay: This feature enables merchants to pay business bills using various methods, including credit card, debit card, bank transfer, or Shopify Balance, regardless of vendor acceptance. A new service also allows merchants to process batch and recurring payments, saving time and reducing transaction fees.

In its most recent quarter, which ended June 30, Shopify reported a 22% year-over-year increase in gross merchandise volume on its platform, totaling $67.2 billion. Additionally, revenue grew by 21% to $2.05 billion. Notably, 117 of the Top 1000 online retailers in North America use Shopify as their e-commerce platform, collectively generating over $9.72 billion in web sales in 2023, highlighting the significant role Shopify plays in the e-commerce landscape.

Retailers Prepare for a Successful Holiday Season

As the holiday season approaches, retailers across the United States are rushing with preparations, ready to embrace what many consider the most magical time of the year. With shopping centers and stores decorated with festive decorations, businesses are expecting an increase in consumer spending, setting the stage for a profitable holiday period.

According to JLL’s 2024 Holiday Shopping Survey, which surveyed over 1,000 consumers, holiday budgets have increased significantly by almost 32% compared to last year. The average consumer is now planning to spend $1,261, up from $958 in 2023. Notably, many of these expenses will occur in physical stores, with only 12.8% of shoppers opting for online shopping exclusively for home delivery.

Major Trends Driving Holiday Spending

- Diverse Holiday Budgets: Consumers are widening their holiday spending to include not just gifts, but also experiences, food, and decorations. While gifts still play a significant role, only 46% of the holiday budget is allocated to them – down from 55% last year. In contrast, spending on food and décor has shot up by 61%, while entertainment budgets have increased by 56.4%.

- Experiential Spending Takes Center Stage: The trend toward prioritizing experiences is notable, with over 95% of shoppers planning to engage in at least one holiday activity, and 76% participating in two or more. Millennials, particularly those aged 30-44, are leading the charge, spending 65.4% more on food and décor and 44.3% more on experiences than other age groups.

- In-Person Shopping Revival: The appeal of physical retail remains strong, with 87.2% of shoppers intending to visit stores in some capacity. Department stores are experiencing a renaissance, emerging as the top destination for holiday shoppers. Approximately 75% of mall shoppers will visit department stores, with high-income earners and men being the primary demographic. In contrast, women, particularly those earning less than $50,000, are more likely to frequent mass merchandisers and discount stores.

Self-Gifting and Personal Spending

Self-gifting continues to rise, with 83% of shoppers planning to treat themselves this holiday season, an increase from 76% in 2023. While apparel and electronics remain top choices, millennials are particularly inclined to indulge, with nearly 90% planning to purchase something for themselves. In contrast, older shoppers (aged 60+) are more conservative, with about one-third opting out of self-gifting altogether.

Key Categories and Consumer Strategies

As holiday shopping intensifies, key gifting trends are emerging. Clothing, electronics, and accessories – especially jewelry – are among the most sought-after gifts. Electronics have gained nearly 13 percentage points in popularity compared to last year, while gift cards have seen a decline of 7 percentage points. Interestingly, over 40% of consumers report that inflation won’t impact their spending plans, although 70% of modest-income shoppers are adapting their strategies. Many are focusing on buying less expensive gifts, exploring secondhand options, or re-gifting items. Gen Z shoppers, in particular, are opting to shop for fewer people and taking advantage of sales.

Strategic location choices, engaging store designs, and a deep understanding of shifting consumer preferences will help retailers build lasting connections with shoppers, driving growth that continues long after the holiday cheer fades. As retailers gear up for a season filled with potential, those who adapt and innovate are likely to reap the rewards.

Optiwise.ai Launches Olivia

Optiwise.ai has launched Olivia, a genAI-powered assistant designed for the Walmart Marketplace. Olivia helps brands optimize their performance by identifying listing and advertising opportunities while providing insights into sales metrics. The assistant offers tailored content suggestions for keywords, titles, descriptions, and pricing, all while considering seasonal trends and retail events. Additionally, Olivia learns from a brand’s existing content, ensuring consistency across marketplaces by replicating it to meet Walmart’s standards. This tool aims to enhance brand visibility and streamline optimization processes on the platform.

PayPal and Global Payments Partnership

PayPal has expanded its partnership with Global Payments to enhance checkout experiences for merchants. The collaboration will provide U.S. retailers with improved PayPal and Venmo branded checkout solutions, allowing for accelerated guest checkout through Fastlane by PayPal. This innovative feature enables users to complete purchases in as little as one click, streamlining the transaction process. Global Payments, a leading acquirer of PayPal’s branded solutions across Europe, the U.K., Canada, and other regions, aims to leverage this partnership to simplify online shopping and boost customer satisfaction.

Amazon Tests Seller Ratings on Product Search Results

Amazon is testing a new feature that displays seller ratings directly in product search results on its marketplace. Currently being rolled out in a limited number of product categories, this initiative aims to help shoppers make more informed purchase decisions. Traditionally, consumers would need to click through to an item and then navigate to the seller’s profile to view their rating. By integrating seller ratings into the search results, Amazon seeks to enhance transparency and improve the overall shopping experience for its customers.

Juphy AI’s Order Tracking Feature: Your Holiday Season Solution

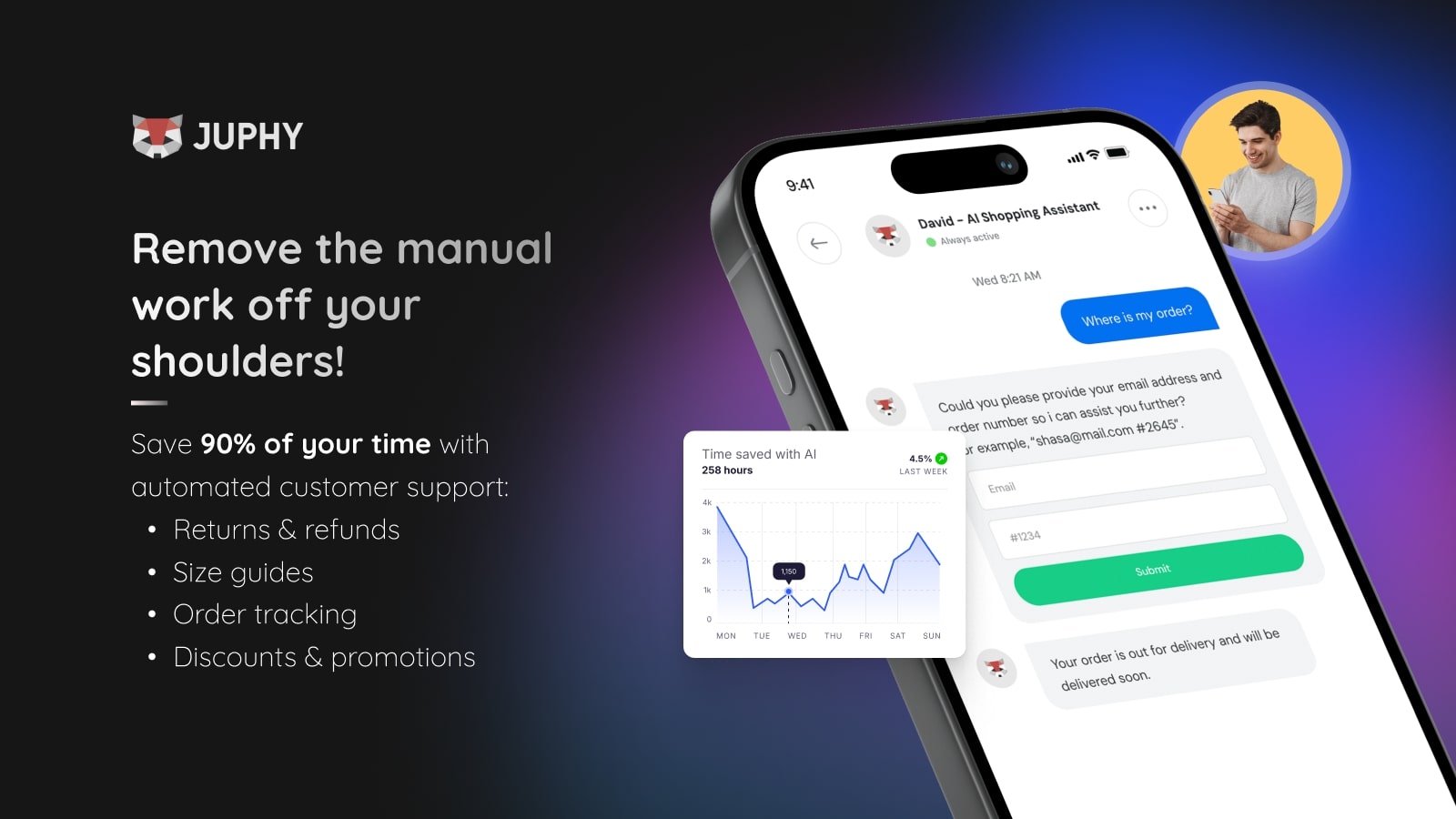

During the bustling holiday season, shoppers want to stay informed about their orders. Keeping customers updated on their order status is crucial, especially as inquiries pile up for e-commerce stores. The pressure can be overwhelming! But this year, Shopify merchants can relax and focus on what truly matters for their businesses. Meet Juphy’s AI Agent, designed specifically for Shopify.

With just one click, you can set it up – no technical skills required! Juphy AI is your reliable partner, offering 24/7 customer support in over 98 languages, even during the busiest holidays. Thanks to its order tracking feature, Juphy’s AI Agent provides real-time updates to your customers, ensuring they stay informed without getting lost in a sea of inquiries. Powered by ChatGPT, Juphy AI delivers human-like interactions that reflect your brand’s tone and style, keeping your customers satisfied and happy while staying informed about their order status.

Don’t miss out on this opportunity – integrate Juphy’s AI Agent into your Shopify store and lighten your holiday workload. Try Juphy AI today: apps.shopify.com/juphy

Key Takeaways

Shopify Launches Financial Suite: Shopify has unveiled a new financial suite to support e-commerce entrepreneurs often overlooked by traditional banks. This suite includes capital funding, commercial credit cards, sales tax management, and a bill-pay system. This initiative aims to transform financial opportunities for startups.

Retailers Prepare for Profitable Holiday Season: As the holiday season approaches, consumer spending is expected to rise significantly, with average budgets up 32% to $1,261. Notably, only 12.8% of shoppers plan to shop exclusively online. Key trends include increased spending on experiences and decorations, with millennials leading the way.

Optiwise.ai Launches Olivia: Optiwise.ai has introduced Olivia, a genAI-powered assistant for Walmart Marketplace sellers. Olivia helps optimize performance by identifying advertising opportunities and providing insights into sales metrics. It offers tailored content suggestions while ensuring consistency across marketplaces by adhering to Walmart’s standards.

PayPal and Global Payments Partnership: PayPal has expanded its partnership with Global Payments to improve checkout for U.S. retailers. The collaboration introduces Fastlane by PayPal, allowing for accelerated guest checkout with a single click. This feature aims to simplify online shopping and enhance customer satisfaction, leveraging Global Payments’ reach across various regions.

Amazon Tests Seller Ratings: Amazon is rolling out a test feature that displays seller ratings directly in product search results. This initiative aims to enhance transparency and aid shoppers in making informed purchase decisions by integrating ratings into the search experience, rather than requiring clicks to view seller profiles.