Juphy’s Weekly E-Commerce News Express – 09-13 June 2025

Ceyda Duz

Welcome to this week’s e-commerce & AI news highlights roundup, offering a closer look at the key developments shaping the online retail landscape. This edition explores various market trends, including recent shifts in e-commerce growth and emerging patterns in retail pricing. We’ll also dive into notable technology innovations, updates, and strategic collaborations designed to enhance merchant operations. Stay informed with the essential trends and insights crucial for sharpening your strategy in this ever-evolving digital arena.

For years, the narrative in e-commerce has been one of great, often double-digit, growth, consistently outpacing traditional retail. However, the latest data for Q1 2025 reveals a notable shift in this dynamic. While online sales continue their upward course, the pace has moderated, reflecting broader economic realities.

After a remarkable nearly two-year period where e-commerce expanded at least twice as fast as overall retail, the first quarter of 2025 saw this ratio narrow. Online sales still demonstrated strong growth, increasing about 1.5 times faster than total retail. This indicates that while the rise has toughened, the fundamental shift towards digital commerce remains in place. It also marks the fifteenth quarter following where e-commerce growth remained below the 10% threshold, a trend distinct from the fast expansion seen in the pre-2021 era.

Understanding the Slowdown: Key Economic Factors

Industry analysis, drawing from recent government figures, points to an intersection of factors contributing to this slower, yet still positive, growth. Several elements are undeniably influencing consumer purchasing habits:

- Economic uncertainty: A general hesitancy among consumers regarding future financial stability.

- Persistent inflationary pressures: Higher prices for goods impacting purchasing power.

- Evolving geopolitical landscapes: Global events creating a climate of unpredictability.

- Tariff concerns: Potential trade barriers influencing consumer spending on discretionary items.

This moderation is a reminder that while e-commerce fundamentally transforms how consumers shop, it is not immune to broader economic forces. Unlike periods of historic e-commerce increases, when digital adoption was the primary growth driver, today’s picture draws a more mature online market interacting with complex global economic challenges.

The Enduring Strength of Online Channels

Despite the slower pace compared to its recent past, it’s important to recognize that e-commerce has consistently shown year-over-year growth for an extended period, reflecting its deep integration into consumer behavior. The movement of retail sales online continues, even if the rate of growth has softened.

For businesses, this trend underscores the imperative of skillfulness and strategic adaptation. While the market may not be delivering the breakneck growth rates of previous years, online channels remain the primary avenue for expansion. Understanding the nuances of current consumer sentiment, navigating economic pressures, and optimizing digital strategies will be paramount for sustained success in this evolving e-commerce environment.

Retail Prices: Don’t Be Fooled by Current Calm, Inflationary Storm Brews

Recent reports may suggest a moderation in retail inflation, with some highlighting lower-than-expected consumer price increases in May. However, a deeper dive into the mechanics of the supply chain and market dynamics reveals a more complex and potentially challenging picture ahead. The current calm is often expected to precede a significant pricing shift, driven largely by the delayed impact of tariffs.

The Temporary Illusion: Why Prices Haven’t Spiked Yet

The current steady inflation figures are not a true reflection of the underlying cost pressures. Several factors are temporarily masking the impending price increases:

- Supply Chain Lag: Goods hitting shelves today were largely ordered and shipped months ago, predating the full impact of higher tariffs.

- Inventory Cushion: Brands and wholesalers are strategically clearing older inventory purchased at pre-tariff rates. This influx of “older stock” temporarily increases supply at lower cost points, keeping prices down.

- Cost Absorption: Across the supply chain – from manufacturers to wholesalers and retailers – businesses are actively collaborating to absorb or share tariff costs, attempting to avoid immediate price hikes for consumers. This short-term strategy, however, has its limits.

- Slow-Moving Stock Clearances: Products that were less fashionable or slower to sell are finding new attractiveness at their pre-tariff prices, as retailers push to move this inventory. This adds to the temporary supply that dampens price increases.

These are tactical maneuvers designed to reduce immediate consumer impact, but they are unsustainable in the long run.

When the True Impact Will Be Felt

The real rise in retail prices, particularly for non-essential items, is anticipated to hit consumers in the third and fourth quarters of the year. It is expected to see initial shifts during the back-to-school season, especially for items with shorter lead times. The holiday season, however, is when the full force of these increased costs will become unavoidable, as almost all products on shelves will reflect the higher tariff rates.

Consumer Response and Strategic Imperatives

Consumers are not entirely unaware of these impending changes. Data suggests a proactive approach, with many advancing their purchases to beat anticipated price increases. Younger demographics, in particular, appear to be highly sensitive to tariff-driven inflation fears. However, when actual price hikes become widespread, a significant portion of consumers indicate they will reduce spending, with categories like electronics, fashion, beauty, and home goods expected to be most impacted.

Ultimately, inflation is a complex cycle. When costs rise, expectations for further increases build, influencing everything. For e-commerce businesses, understanding these underlying dynamics, rather than just reacting to headline figures, will be essential for navigating the challenging quarters ahead. Proactive pricing strategies, transparent communication, and careful inventory management will be key to weathering this coming storm.

Sales Tax Simplified: Shopify Integrates with Sovos for Automated Compliance

For e-commerce merchants navigating the intricate web of U.S. sales tax regulations, administrative burden can significantly detract from core business activities. Addressing this critical need, Shopify has enhanced its platform by integrating with Sovos, a tax and regulatory compliance company. This collaboration introduces an automated solution for eligible U.S. merchants, streamlining the entire sales tax process. Through the integration of Sovos’s Sales and Use Tax Filing service with Shopify Tax, merchants gain access to comprehensive automation for the preparation, filing, and remittance of their sales tax returns.

Next-Gen Checkout: Bolt and Palantir Introduce AI-Powered Personalization

The e-commerce checkout experience is poised for a significant transformation with the new collaboration between Bolt, a checkout technology company, and Palantir, an AI software provider. This partnership introduces “Checkout 2.0”, an intelligent system designed to change the final stage of the online shopping journey. This solution is engineered as a self-learning and self-improving platform, providing an adaptive, real-time experience tailored to each individual shopper. Checkout 2.0 is built to respond dynamically to user preferences, behaviors, and contextual cues. It delivers highly personalized flows that evolve with the user, intelligently prioritizing preferred payment methods, recalling past selections, and surfacing relevant information precisely when needed, ultimately creating a more seamless and intuitive purchasing process.

Enhanced Visibility: Google Boosts Loyalty Programs in Search Results

In a significant update for online retailers, Google has rolled out new support for structured data markup specifically for loyalty programs. This development offers a direct pathway for businesses to showcase member benefits directly within search results, providing a crucial advantage in attracting and retaining customers. The new functionality allows companies to define their loyalty offerings in a structured format that Google can interpret and display. For merchants without a Google Merchant Center account, the update enables the definition of loyalty programs through a combination of existing organization-structured data and specific loyalty benefits.

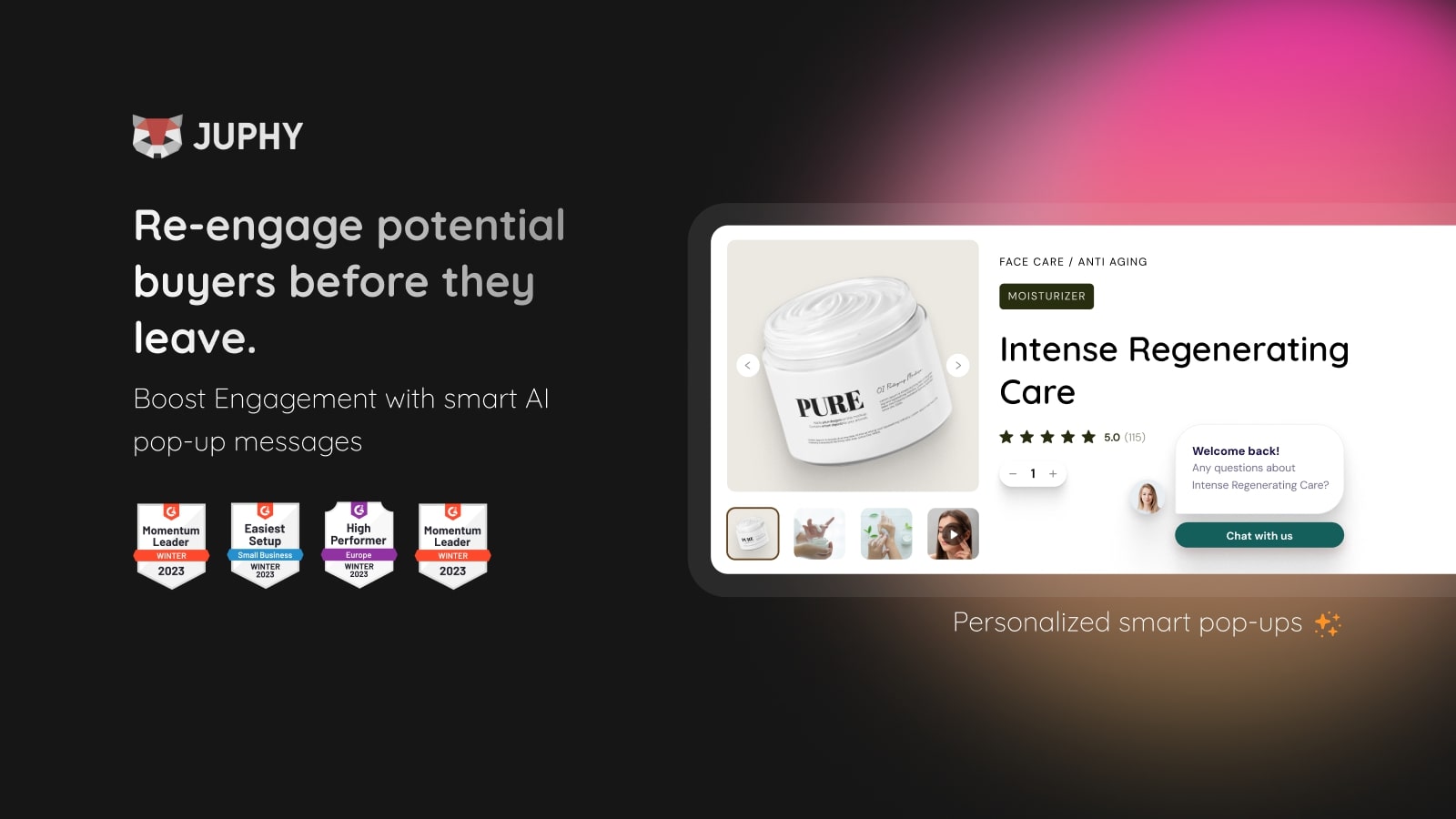

Smarter Engagement in Slower Times: How Juphy’s AI Popups Support Sales in a Cautious Market

In a Q1 defined by slower e-commerce growth and more hesitant shoppers, delivering timely, relevant assistance has never been more important. Juphy AI helps Shopify merchants replicate the in-store sales experience online with Smart AI Popups — engaging visitors at key moments in their journey to reduce drop-offs and encourage purchases.

From welcoming new visitors and re-engaging those about to exit, to assisting on product and cart pages, Juphy’s intelligent modules offer real-time suggestions, answer pre-sale questions, and highlight relevant products. These proactive interactions guide shoppers, build trust, and create a smoother path to purchase — especially critical in a market where every conversion counts.

Try Juphy AI for free today and turn more visitors into loyal customers!

Key Takeaways

E-Commerce Growth Cools, But Still Climbs: Online sales grew 1.5x faster than retail in Q1 2025—slower than previous years, but still positive. Inflation, economic uncertainty, and global instability are moderating growth. The shift signals a more mature market where brands must focus on strategic, customer-focused execution.

Retail Prices: Calm Now, Storm Coming: Retail inflation looks tame—for now. Delayed effects of tariffs, old inventory, and cost absorption are masking true price hikes. Expect noticeable increases by Q3–Q4, especially during the holiday season. Proactive shoppers and pricing strategies will be key.

Shopify x Sovos: Tax Filing Made Easy: Shopify has partnered with Sovos to automate U.S. sales tax filing and remittance. The integration simplifies compliance for merchants, cutting down time spent on paperwork and improving accuracy. A big win for operational efficiency.

Bolt & Palantir Launch Smart Checkout 2.0: Bolt and Palantir teamed up to create a personalized, AI-powered checkout experience. Checkout 2.0 adapts in real-time to each user, streamlining payment, surfacing relevant info, and remembering past behaviors. A major upgrade for conversion-focused brands.

Google Highlights Loyalty Programs in Search: Google now supports structured data for loyalty programs—letting brands showcase member benefits right in search results. This boosts visibility and gives merchants a new tool to attract and retain customers without relying solely on paid ads.