Juphy’s Weekly E-Commerce News Express – 21-25 April 2025

Ceyda Duz

Keeping up with the fast-paced world of e-commerce can be a challenge. That’s why we’ve compiled the week’s most important news, from Amazon’s evolving strategy in the low-cost market and the rise of AI-powered tools for media buying, to the latest updates from big players. Get ready for a quick rundown of what’s making waves in the online retail space. Let’s get started!

Amazon Expands Low-Cost “Haul” Store Amidst Cross-Border E-Commerce Shifts

Amazon is expanding its recently launched low-cost “Haul” retail channel, introducing desktop access and broadening its product assortment to include branded items. This development occurs six months after the initial mobile-only beta launch and coincides with the impending implementation of new tariffs on direct-from-China shipments by the U.S. administration.

Amazon Haul’s Strategic Expansion

Launched in November 2024, Amazon Haul features products priced at $20 or less, with a significant portion under $10. The platform’s expansion to desktop and the inclusion of branded goods represent a strategic move as new tariff policies are set to impact the cross-border e-commerce landscape.

Impact of Impending Tariffs

The upcoming tariffs, scheduled to begin on May 2, 2025, will end the de minimis exemption for packages valued at $800 or less shipped from China via the U.S. Postal Service. These shipments will be subject to tariffs starting at 120% of the goods’ value or a $100 fee per package, increasing to $200 in June. Shipments via other carriers may face even higher tariff rates.

These policy changes pose a potential challenge to the business models of ultra-low-price platforms that rely on direct-to-consumer shipments from Chinese manufacturers. Several of these platforms have already indicated that consumers may see price adjustments.

Amazon’s Response and Key Features of Haul’s Expansion

Amazon’s expansion of Haul includes making the platform accessible on desktop, as announced by a company executive. Additionally, the product selection has been diversified to include discounted branded items alongside the existing ultra-low-priced unbranded goods. This hybrid approach aims to appeal to a wider range of price-sensitive consumers.

A key differentiator for Amazon Haul is its reliance on the company’s established fulfillment infrastructure. Unlike platforms that primarily ship directly from overseas, Amazon utilizes its U.S.-based warehouses for many Haul products. This fulfillment model may offer a degree of insulation from the direct impact of the new tariffs on individual shipments.

Focus on Trust and Shopping Experience

Amazon is also emphasizing consumer trust and product quality within the Haul platform, highlighting measures to ensure product safety and authenticity, as well as the application of its A-to-Z guarantee to all purchases.

While Amazon Haul is incorporating some elements aimed at enhancing the shopping experience, it currently differs from some competitors in its lack of extensive gamification and social shopping features.

Looking Ahead in the E-Commerce Landscape

The decision to expand Haul’s accessibility and product range, coupled with its prominent placement on Amazon’s digital properties, suggests a strategic focus on this low-cost channel. The coming months will be significant in determining the competitive dynamics of the ultra-low-cost e-commerce market as the new tariff policies take effect.

Deloitte Report Highlights Social Media’s Growing Influence on Media Consumption

A recent report from Deloitte, the “2025 Digital Media Trends”, underscores the increasing prominence of social platforms in the media and entertainment landscape. The findings, based on an October 2024 survey of over 3,500 U.S. consumers across various age groups, reveal evolving media consumption habits. The report highlights that this trend is driven by the increasing relevance and personal connection that younger generations feel towards social media content creators.

Time Spent Engaging with Media

The study indicates that, on average, U.S. consumers dedicate approximately 6 hours daily to engaging with media and entertainment content. However, the specific activities vary significantly across generations. For instance, while older generations allocate more time to watching traditional TV and movies, younger demographics, particularly Gen Z and Millennials, spend substantial time on social media and consuming user-generated content.

Device Preferences for Different Media

The Deloitte report also sheds light on device preferences for various entertainment activities. Smart TVs remain the preferred device for watching TV shows and movies on streaming services. In contrast, mobile phones and tablets are the dominant devices for activities like scrolling through social media and watching both short-form and long-form videos.

Connection with Social Media Creators

The survey highlights a stronger connection between younger consumers and social media content creators. Gen Z and Millennials are more likely to perceive social media content as relevant and report feeling a more personal connection with online creators compared to traditional TV personalities.

Interest in Creator Transition to Traditional Media

Interestingly, the report also indicates that younger demographics express a greater likelihood of watching traditional media like TV shows and movies if their favorite online creators were to star in them. This suggests a potential blurring of lines between social media-based entertainment and more traditional forms of content.

In conclusion, Deloitte’s “2025 Digital Media Trends” report paints a picture of a media landscape where social platforms play an increasingly central role, particularly for younger generations. The findings have implications for content creators, media companies, and advertisers as they navigate the evolving preferences and consumption habits of American consumers.

ShipBob and Temu Partner for U.S. E-Commerce Expansion

Shipping and fulfillment platform ShipBob has announced a partnership and integration with global marketplace Temu. This collaboration allows ShipBob’s small and medium-sized business clients to easily reach Temu’s broad U.S. customer base. The integration simplifies operations by enabling seamless syncing of product listings, inventory, and order details. ShipBob will handle fulfillment for these Temu orders from its U.S.-based warehouses, offering a streamlined solution for merchants looking to grow their sales on the popular platform.

Bringg’s Dynamic Delivery Slots for E-Commerce Checkout

Last-mile delivery solutions provider Bringg has launched its Dynamic Delivery Slots extension. This new feature allows e-commerce merchants to offer customers precise delivery window options directly during the checkout process. Bringg states that the system continuously analyzes a range of factors, including real-time delivery capacity, order specifications, driver availability and compliance, service areas, and any blackout periods, to provide accurate and flexible delivery slot choices. This aims to improve the customer experience and optimize delivery operations for merchants.

Lili Integrates Financial Tools with E-Commerce Platforms

Lili, a financial platform focused on small business owners, has introduced a new suite of monetary tools. Through its “Connect” embedded finance integration, Lili is partnering with e-commerce platforms to offer tailored banking, accounting, and tax solutions. This aims to simplify financial management for online businesses. Initial e-commerce partners leveraging Lili Connect include Convesio, North Commerce, and Hostinger, enabling their merchants to directly open a business checking account through the platform.

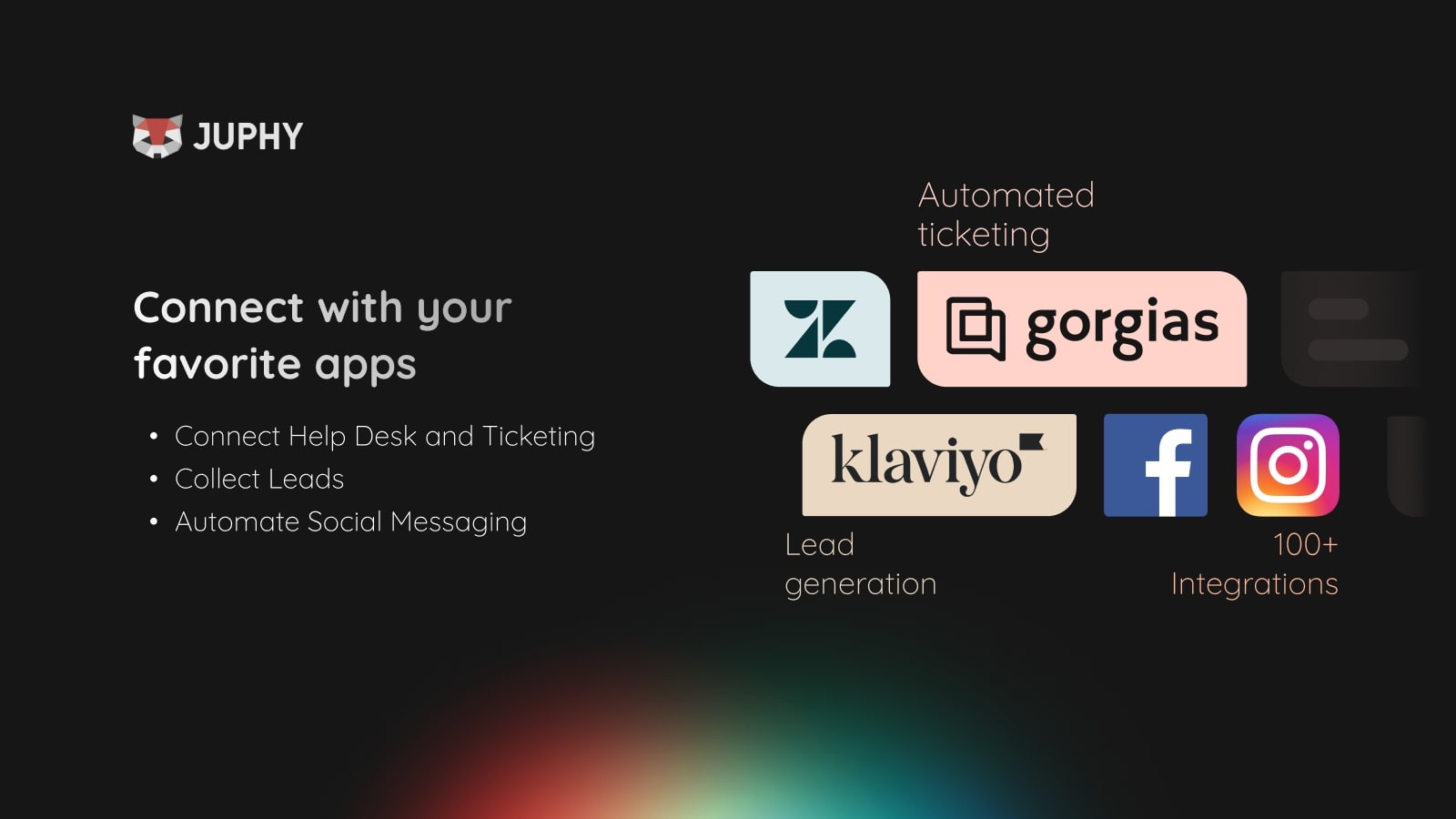

Smarter Operations Through Integrations with Juphy

With Amazon doubling down on fulfillment speed and consumers engaging brands across multiple platforms, e-commerce businesses need systems that work together. Juphy helps Shopify merchants stay efficient with deep integrations across key tools—whether it’s handling customer DMs on Instagram, syncing support tickets with Zendesk or Gorgias, or capturing marketing leads through Klaviyo. Instead of juggling tabs and channels, you get a unified workflow that keeps support fast and marketing sharp—right where your customers are. Get started now and streamline your store’s daily operations with Juphy’s AI Agent: apps.shopify.com/juphy

Key Takeaways

Amazon Expands Haul Store: Amazon is expanding its ultra-low-cost Haul store to desktop and adding branded items, just as the U.S. prepares to roll out steep tariffs on shipments from China. The timing positions Amazon to gain an edge over Chinese platforms by leveraging its U.S.-based fulfillment network and customer trust.

Deloitte: Gen Z Turns to Creators Over TV: Deloitte’s latest report shows that social media is now the top media channel for younger generations, overtaking traditional TV. Gen Z and Millennials feel a stronger connection to creators than to mainstream celebrities, reshaping how entertainment is consumed and produced.

ShipBob and Temu Join Forces: ShipBob has partnered with Temu to help U.S. merchants tap into the marketplace’s vast customer base. The integration simplifies product syncing and fulfillment, offering small businesses an easier path to growth on a global scale.

Bringg Adds Smart Delivery Slot Selection: Bringg’s new Dynamic Delivery Slots tool lets online shoppers choose accurate delivery windows during checkout. By analyzing real-time delivery factors, the feature helps merchants improve fulfillment efficiency while increasing customer satisfaction.

Lili’s Finance Tools for E-Commerce Platforms: Lili is integrating its banking and accounting tools into leading e-commerce platforms, aiming to simplify money management for online sellers. The new embedded finance solution gives small business owners a more connected financial experience.