Streamlining Your Transactions with Shopify Payments

Zeynep Avan

Your Shopify Store can be perfectly built with a great user interface and customer experience. Think of this part as the introduction and development. However, the result is also part of this customer journey, and like the previous experiences, it should end perfectly. Shopify Payments provides that end result with an easy checkout experience, not only for the customer but also for Shopify Store owners.

It offers an easy setup, security, and different payment methods, and here is how you can set it up.

Understanding Shopify Payments

Of all the payment gateways, all of which are great, Shopify Payments is designed specifically for Shopify users, making it an excellent choice for those building their online business.

What Is Shopify Payments?

Shopify Payments is a payment provider built just for Shopify. This means that if you have a Shopify store, you can easily start accepting payments without having to add anything extra. All you need to do is activate your Shopify Payments, and that’s it.

Unlike many other e-commerce platforms that require separate payment providers (e.g. Stripe or PayPal) to be connected, Shopify Payments offers a built-in solution.

It enables businesses to accept various forms of payment, including major credit cards like Visa and Mastercard, as well as digital wallets like Apple Pay and Google Pay.

This built-in functionality simplifies the setup process, allowing Shopify store owners to start accepting payments immediately after entering their bank account details into their settings.

The Benefits of Using Shopify Payments for Your Store

As Shopify Payments (SP) is built right into your Shopify store, you don’t have to deal with setting up and managing a separate payment platform.

Enter your bank details in Shopify’s settings and you’re ready to go. This means less friction for you and a smoother process from start to finish.

But it does not stop there –SP comes with many other benefits that add to your store, sales, and financial operations:

- SP charges a fee for every sale (2.9% + 30 cents), but this is pretty standard. The good thing is that there are no surprise fees, and everything is clear from the start.

- Shopify sends your money every day except on weekends. This means you don’t need to wait long to see the profits from your sales in your bank account.

- Your customers can pay in many different ways, which can help you make more sales. You can accept regular credit cards as well as digital wallets like Apple Pay.

- Shopify Payments gives you data for Shopify reports and is clearly aligned with the rest of your analytics.

- It provides Shopify POS, which helps you with both online and offline sales.

So, we can talk about its benefits under these topics:

- Simple setup

- Reasonable fees

- Fast payments

- Different payment options

- Data for Shopify reports

- Online and offline sales

Preparing to Use Shopify Payments

Before you start with Shopify Payments, there are two steps you need to check off your list to make sure everything goes smoothly.

Eligibility and Bank Account Requirements

First things first: not all stores can use Shopify Payments right away. It depends on where your store is based.

Think of it as needing to be in a certain club to use it. If your country isn’t on the list for Shopify Payments, you’ll need to find a different way to take payments, like using PayPal or another service that works in your area.

Next up, you’ll need a bank account where Shopify can send the money you make from your sales.

Depending on where you live and what kind of business you have, Shopify will ask for different information. For most people, this means telling Shopify about your business, who owns it, and where your bank account is.

The Importance of Two-Step Authentication

Two-step authentication adds an extra layer to your safety. It means that even if someone finds out your password, they can’t get in unless they also have this second key, which could be a code sent to your phone. Setting this up is a good move because it keeps your store and money safe.

So, getting ready to use SP is mostly about checking if you can use it where you live, setting up your bank account with Shopify, and adding that extra security to keep everything safe. Once you’ve done these steps, you’re all set to start selling and making money with your store.

Setting Up Shopify Payments

After you’ve checked that you can use SP and have your bank account ready, it’s time to set up your store to start accepting payments. It’s like setting up a new unit – follow the steps, and you’ll be up and running in no time.

Step-by-Step Setup Guide

- Sign in to Shopify: Start by signing in to your Shopify account and go to the dashboard.

- Find Settings: Look for the “Settings” option, usually found at the bottom left. Click on it and then select “Payments“.

- Select Shopify Payments: If Shopify Payments is available to you, then it appears as an option here. Click on it to get started.

- Fill in your Business Information: Shopify asks questions about your business type, such as whether you’re operating as a sole seller or as a company and where you’re located. Fill in all the details as accurately as possible.

- Add Bank Details: This is where the money you earn will be sent, so double-check to make sure everything is correct.

- Set Security: Enable two-step authentication to keep your account extra safe.

- Complete Account Setup: Finish by reviewing all the information you’ve entered and confirm to complete the setup.

Understanding Fees and Charges

Shopify Payments has a straightforward fee structure, but one of the biggest perks is what you don’t have to pay:

When you use SP, you’re not charged additional fees for transactions made through Shopify Payments, Shop Pay, Shop Pay Installments, or Paypal Express. This is a significant advantage, as it can reduce the overall costs of processing payments.

If your customer pays with cash, Cash on Delivery (COD), or bank transfers, again, Shopify doesn’t take a transaction fee. This is also the case if you’re on a Shopify Plus plan, though there are exceptions if your business is located in Austria, Belgium, or Sweden.

Whether you’re selling in person or online, there are rates applied to credit card transactions. These rates are part of using Shopify Payments and vary depending on the plan you choose.

| Payment Method | Transaction Fee | Additional Fee |

| Shopify Payments/Shop Pay | Standard credit card rate | No additional transaction fees |

| PayPal Express | Standard credit card rate | No additional transaction fees |

| Cash, COD, Bank Transfers | None | Available for transactions not processed through Shopify |

| Shopify Plus (specific countries) | None | No transaction fees, with exceptions |

| Credit Card Transactions | Varies by plan | In-person and online rates apply |

Maximizing the Potential of Shopify Payments

Setting up Shopify Payments is just the beginning. To really get the most out of this built-in payment method, you can optimize it to fit your business perfectly, improve security, and even use it to sell globally.

Customizing Your Payment Options

Shopify Payments isn’t just about accepting credit cards. You’ve got a lot of flexibility in offering the payment methods your customers prefer.

Shopify Payments offers you payment methods, such as:

- Apple Pay

- Amazon Pay

- PayPal

- Visa

- Meta Pay

- Klarna

- MasterCard

- Maestro

- Google Pay

- Shop Pay

Whether it’s Apple Pay, Google Pay, or even buy now, pay later options like Shop Pay Installments, you can choose what works best for your audience. This customization can help improve your conversion rates since customers love having options that work best for them.

Enhancing Security Measures for You and Your Customers

Security isn’t just a nice-to-have; it’s a must. Shopify Payments comes with built-in fraud analysis and supports 3D Secure checkouts, which can help protect against fraudulent transactions.

By activating features like two-step authentication, you can add an extra layer of security to your account, keeping both your business and customer information safe.

Utilizing Shopify Payments for Global Sales

If you’re thinking of selling internationally, Shopify Payments has got you covered. It allows you to accept payments in multiple currencies, making it easier for customers worldwide to buy from you.

Plus, Shopify automatically handles currency conversions, so you don’t have to worry about the details.

Troubleshooting Common Issues with Shopify Payments

Even with the best setup, you might run into a few bumps along the way. Knowing how to handle these issues can keep your sales process smooth.

Resolving Payment Disputes and Chargebacks

Disputes and chargebacks can be a headache, but Shopify Payments helps you manage them.

Shopify provides tools to respond and submit evidence directly through your dashboard if a customer disputes a charge.

Keeping detailed records of transactions and customer interactions can be invaluable in resolving these issues.

Addressing Common Customer Payment Queries

Customers might have questions about their payments, like why a transaction was declined.

Shopify Payments offers detailed information on transaction statuses, which can help you troubleshoot issues.

Often, declines are due to the bank or card issuer, so encouraging customers to check with their bank can resolve many queries.

How Juphy AI Enhances the Shopify Payments Experience

Who paid you, and who can pay more? There are two different questions with two different answers.

Maximize Shopify Sales with Juphy AI: ChatGPT-powered Sales Assistant 🚀

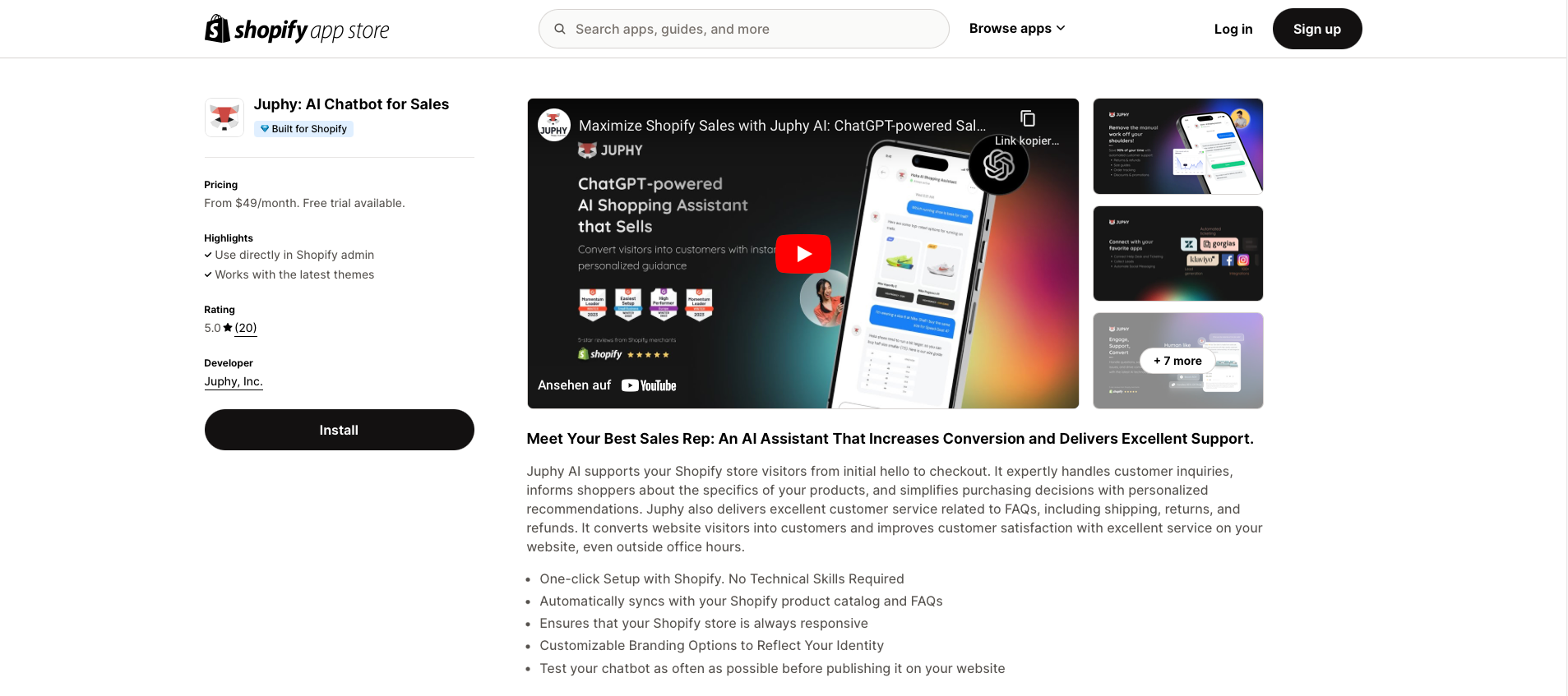

Shopify Payments helps you create a great built-in payment method for your store, while platforms like Juphy AI help you earn more customers through meaningful interactions to boost sales. Both tools are easily managed from the Shopify dashboard, as Juphy’s AI Agent is specifically designed for Shopify and features the ‘Built for Shopify’ badge.

Boosting Sales through Personalized Product Recommendations

Juphy AI stands out by providing highly personalized shopping experiences, which increase the chance of making a purchase.

Juphy’s AI Agent integrates with Shopify easily in just one click without the need for any technical skills.

After a simple installation from the Shopify App Store, it begins to scan your site and understand your products, policies, and brand tone.

By remembering customer preferences, interests, past transactions, and browsing patterns, it makes it possible to create personalized interactions with them.

By suggesting new arrivals, related products, or special offers, Juphy AI significantly boosts buying intent.

Streamlining Customer Support with AI

Beyond product recommendations, Juphy AI stands out in customer support. By working 24/7, the chatbot ensures that customers have guidance and support whenever needed.

This presence reduces the number of abandoned carts and increases customer satisfaction.

For complex issues that arise, like payment problems, Juphy’s AI Agent offers an agent handover feature that directs customers to a primary contact, allowing your team to step in when human assistance is needed.

Conclusion

Your Shopify store is more than just a place to sell products; it’s a complete journey for your customers, from when they land on your page to when they complete their purchase. Ensuring this journey is seamless and enjoyable is important.

Shopify Payments simplifies the transaction process, making it easy for you and your customers. It’s designed specifically for Shopify users, ensuring a smooth integration that allows you to accept various payment methods.

Juphy AI improves this experience by adding a layer of personalized interaction and support. It acts as a 24/7 virtual assistant, providing product recommendations, answering questions, and guiding customers through shopping.

Key Takeaways

- With Shopify Payments, setting up and managing your store’s payment system is straightforward.

- Activating Shopify Payments is straightforward—simply enter your bank account details in Shopify’s settings to get started.

- Shopify Payments allows you to accept various forms of payment, including major credit cards and digital wallets like Apple Pay and Google Pay.

- The fee structure for Shopify Payments is clear and upfront, with no hidden costs.

- Shopify Payments integrates with your Shopify reports, providing valuable insights into your sales and financial performance.

- Shopify Payments enables you to accept payments in multiple currencies.

- Juphy AI’s personalized interactions ensure customers receive custom recommendations and support.