Best Strategies for Fintech Customer Service in 2023

Sudeepa Bose

The wave of digital transformation has dramatically hit the finance sector, making FinTech companies evolve significantly and are under immense pressure to offer customers something better.

This is not surprising, given that customers expect the same level of convenience and customer service from their bank as they do from other online businesses.

And with customers having a plethora of options, customer service in FinTech has now become both a differentiator and a growth accelerator.

According to a Boston Consulting Group study, around 43% of customers would leave their bank if it failed to provide an excellent digital experience.

While some companies are shaking up the financial sector as they live and breathe customer support, many fintech startups still need help to perfect the customer service side of their business.

The fact that most fintech companies deliver an unremarkable customer experience means the competition is tough for startups. Yet, you have immense potential to stand out from the herd and become the go-to fintech company by delivering an exceptional customer-centric experience.

In the digital era, if your FinTech company or a startup needs to deliver a highly positive customer experience, this blog will help you change gears and march toward providing better, more customer-centric approaches.

So, if you want to avoid being left eating their dust, then keep scrolling!

But before you jump-start to the best strategies to deliver high-quality customer service, let’s understand why customer service is essential for FinTech.

So, without much ado, let’s get started.

Why Is Customer Service Important for FinTech?

Great customer service is a company’s best marketing. It drives positive reputations, reviews, stock prices, employee satisfaction, and revenues.

The 2008 financial crisis weakened people’s trust in traditional public banks and pivoted their attention towards the newer, fancier fintech revolution.

Financial technology, or FinTech, is emerging as a game-changer and is changing the narrative around customer support for financial institutions.

Most of what banks can do for customers in person, a FinTech support service can do better. They are agile, offer personalized service, and are available 24×7, even remotely.

FinTech support offers customers enhanced convenience, experience, transparency & choice by alluding them to modern and intuitive interfaces and personalized customer support and expertise.

Some of the features of the FinTech support services are:

- They act as an intermediary between advisors and customers;

- They are customer-oriented;

- They aim to make financial services as comfortable as possible for customers;

- Provide customers with a satisfying customer experience;

- They remove the burden of having to meet a financial advisor in person;

- They can be available 24/7

- Provide banks with customer feedback and analytics. Such data is valuable for financial institutions as it gives them insight into what can be improved.

While many FinTech offers excellent features, some still need help keeping customers happy because customers expect a satisfying customer experience.

An April 2021 study from J.D. Power found that banks without a branch outperformed traditional banks on customer satisfaction. This difference in performance was because the top-notch financial customer service includes:

- Relevant and meaningful financial advice;

- Emphasizing a practical and comfortable customer journey;

- Focusing on advisor-customer communication;

- Addressing customer dissatisfaction, etc.

Increasing customer expectations and changing behaviors have forced FinTech to bring in their A-game to meet customer needs and stay competitive with a customer-first mindset.

Customers are increasingly unwilling to give second chances if expectations aren’t met. A recent study by PwC concluded that around 86% of customers considered leaving their bank if it failed to meet their needs.

Therefore, it has become imperative for FinTech to provide quality customer services to help customers, reduce complaints, deliver personalized experiences, and improve overall customer experience.

With that said, let’s move forward to the best tips to help you fine-tune your customer service offerings and increase customer loyalty and satisfaction.

Best Customer Service Strategies for Fintech in 2023

High-quality customer service will help your company harbor customer trust and loyalty, maintain a positive relationship with customers, and boost customer satisfaction. And all this is possible with a solid customer service strategy.

As your fintech company is redefining or designing a customer service strategy, consider the following questions:

- Where are your customers most likely to communicate with you–email, phone, or social media?

- What information do you provide to customers to be able to problem-solve on their own?

- How do you enable customers to interface with your team and share feedback?

Here is a list of the best customer service strategies that your fintech company needs to sustain and thrive in the already competitive fintech landscape.

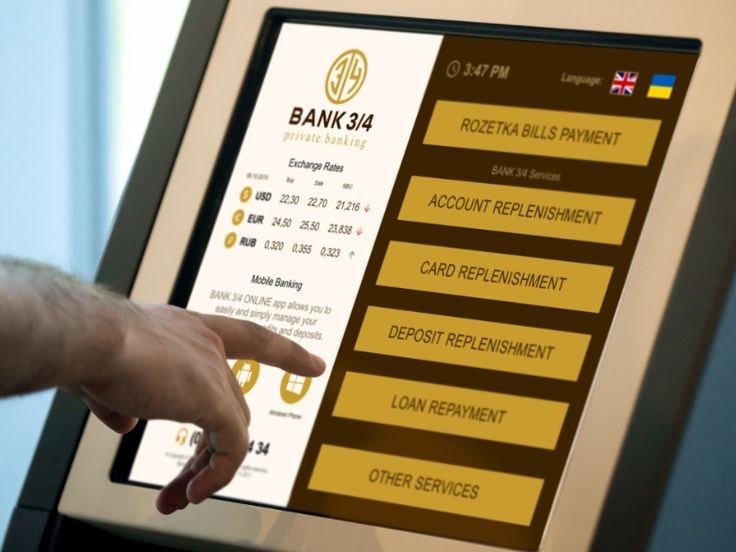

1. Provide an Omnichannel Experience

Omnichannel is much more than just providing multiple ways for customers to transact. It is about a seamless and consistent interaction between customers and their financial institutions across various channels. Omnichannel customer service comes with a lot of benefits, such as:

- A client-centric view

- Allowing clients to interact with the bank via multiple channels

- Trying to understand what clients want and need through analytics

- Based on systems of engagement

- Relying on big data: integration of customer context

Oracle reports that over 80 percent of customers use digital channels to engage with financial institutions. And 66 percent of respondents state that “experience is a major factor when choosing payment and transfer services.”

That’s not all. Recent trends data shows that around 95% of customers use three or more channels in just one interaction with a brand.

So teams must be able to deliver an omnichannel customer experience that lets customers complete transactions and receive customer service on the digital channels they use most.

Omnichannel customer support equips your financial company with all the required tools to help different types of customers, which allows you to customize the customer journey.

Hence, improving customer satisfaction in financial services is key to boosting customer loyalty.

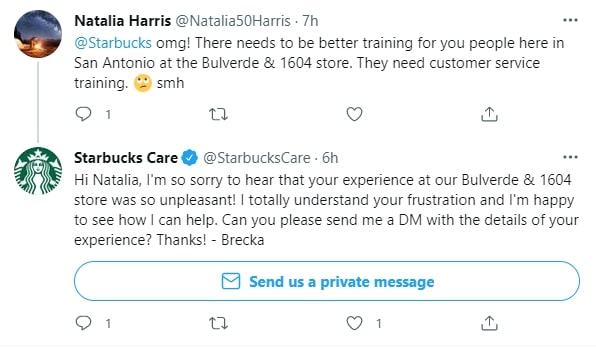

An omnichannel support solution like Juphy allows you to consolidate all your service channels to help you manage incoming requests from a single view, creating greater consistency.

Pro Tip: Juphy’s Social Inbox integrates several social media platforms to bring all your conversations into a unified inbox and helps to access all the incoming messages in real-time.

This allows you to be fully present in the conversation, providing informed support and anticipating customers’ needs.

2. Offer Greater Control with Self-Service Tools

Self-service is no more a “nice to have” feature. It’s a vital requirement to provide a positive customer experience. It has become so crucial that around 70% of customers expect a company’s website to include a self-service application.

Self-service tools are part of Fintech customer service and can complement your financial customer service. Data suggests that over 69 percent of people prefer to resolve issues independently before contacting customer support.

Customer self-service is paramount to customer satisfaction in financial services as it allows customers to avoid unnecessary interactions with customer support and solve issues independently. Additionally, this frees up your agents to handle more complex situations.

Improve your customer service strategy with self-service banking technology that enables you to help your customers help themselves while reducing ticket volumes, wait times, and customer frustration.

You can empower your customers to take matters into their own hands via a help center. Furnish all the necessary information in your help center, and make it easy to access directly from your company’s website and app.

Some of the key benefits of customer self-service are:

- Reduced costs: Self-service enables large-scale customer support at a reduced price and helps banks reduce the number of customer service teams as part of digital transformation in banking.

- Round-the-clock support: Fintech customer service offers 24/7 support, and customers can access self-service anytime, giving them the flexibility they require.

- More productive customer support staff: Most customer issue tickets raised are repetitive. Self-service alleviates the support team by reducing the number of repetitive tickets in the queue.

- Increased sales and revenue: Customer satisfaction is improved when clients solve most of their issues via self-service. And happier customers are more likely to do more transactions and increase sales and revenue.

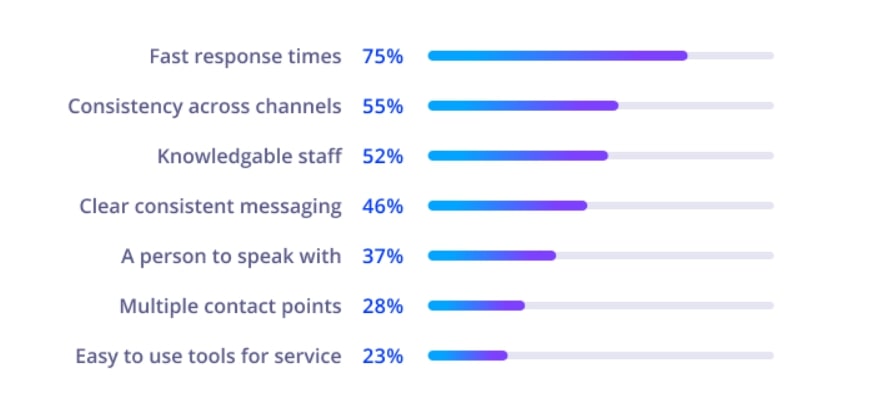

3. Improve Customer Response Time

Customer service response time is the average time your company’s support team takes to respond to a customer’s request or complaint ticket via contact form email, social media DM, live chat, or any other channel.

A vital aspect of quality customer service is responding to consumers promptly. More and more customers expect near real-time access to companies across multiple channels.

In fact, according to the customers themselves, fast response time is the essential element of a good customer experience.

A survey by Hubspot showed that 90% of customers rate an “immediate” response as very important when they have a customer service question.

- Setting goals for your customer response time is the first step to improving your customer response time.

- You can employ customer relationship management (CRM) tools like Juphy to maintain a record of your company’s overall and social media key performance indicators (KPIs) and give you reports when needed.

- You can prioritize queries according to customer tickets with varying urgency and importance levels. Respond to customer tickets based on how critical or pressing their issue is.

- For the most common questions, you can reply from the canned response template and leave the most complex queries for the live chat agents.

Pro Tip: Answer routine questions like uploading documents online or getting a passbook. Such common queries can be managed with Juphy’s Canned Response feature and use Juphy’s Reports to track customer reps’ performance, KPIs, and tickets.

4. Stay Consistent Across All Channels

Good customer service is all about consistency. According to Salesforce, over 75% of consumers look forward to a consistent experience across multiple channels for customer service.

And seventy-three percent of consumers are likely to switch brands if they don’t get it. Prioritizing customer care will improve the chances of customers remaining loyal.

Around 40 percent of customers use multiple channels for the same issue, and 90% of consumers desire a consistent experience across all channels and devices.

So, to deliver a consistent experience, it is essential for every department in your company, from call center agents to sales staff to marketing, to be aligned with the response strategy for every possible customer-related issue. This includes understanding the role of a customer service representative.

Moreover, preparing customer service guidelines will serve as a manual for your customer service team to ensure brand consistency and quality.

Here are some questions you should address in your social media customer service brand guidelines.

- Desired response time for each complaint

- What tone of voice should you adopt?

- How to handle a social media crisis?

- How to respond to positive feedback (liking, commenting, reposting)?

- Templates with answers to common queries to ensure that tone of the response is consistent.

Brand guidelines are essential for distributed teams as it holds all team members to establish similar KPIs, such as conversations per hour or time to resolve an issue.

These guidelines will empower your customer service team to offer appropriate and personable support.

No matter which team member is solving a complaint, every customer will be able to gain a similar experience if brand guidelines are established and followed within your team.

Pre-defined templates with answers to common queries to ensure that tone of the response is consistent.

Moreover, integrating all social media platforms in a single inbox can help your team promptly provide consistent customer service, irrespective of the channel they prefer to communicate.

Pro Tip: Juphy’s Team Collaboration helps work collaboratively on the unified Social Inbox and stay consistent across all channels.

Learn tips, tricks, and secrets of social media customer service with this free e-book. Download it for free now!

5. Humanize & Personalize Customer Interactions

Customer demands are evolving, including the desire for greater personalization. Employing the human touch will help exceed customer expectations and improve customer retention.

According to Global Banking and Finance Review, “retaining the human touch” is one of the most significant challenges fintech companies face as they build and refine their tech arsenals.

Many FinTech companies rely on a network of chatbots to answer customer problems, which can get frustrating quickly without resolving a request.

Make sure your customer engagement has a human touch and delivers personalized customer service. Empower them to move seamlessly between channels, but don’t prescribe the journey. Everyone customer is different and has dissimilar needs.

While you may leverage technology to handle simple interactions, make it easy for customers to speak to a human being whenever they want.

Personalize your responses on a case-by-case basis to be specific to fit the customer’s needs.

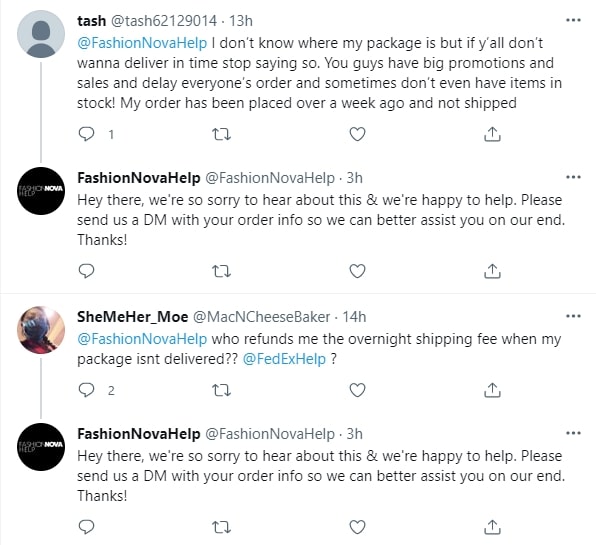

Here’s how you can add a human touch to your social media responses.

- Use the customer’s name

- Reply with a positive tone

- Show empathy and apologize when necessary

- Close replies with the agent’s name or initials rather than your company name

Humanizing customer interactions aim to make the customer feel exclusive by giving proper communication with empathy. And your company can offer a warmer, more personalized customer experience, exceed customer expectations and improve customer retention.

Pro Tip: Use Juphy’s automation rules to classify messages based on content, urgency, and tone and decide what issue needs the canned response and what issue needs the human touch.

6. Gather Customer Feedback

Gathering customer feedback helps determine how satisfied or dissatisfied customers are with your product/services. Valuable feedback provides insight into what needs improvement and helps improve your customer service experience.

Customer feedback is vital for your FinTech company because:

- It points out what aspects of your product/services need improvement

- It makes customers feel heard, involved, and valued.

- It generates personal recommendations

- It helps to convince customers to come back for more

- It helps to acquire new customers

- It helps you to build brand loyalty

- Negative feedback can be seen as a chance to improve the product

But, most clients avoid surveys as they consider them time-consuming and tedious. You may also notice a drop in your engagement rate if you put in a lot of surveys.

You can avoid this by:

- Including surveys in emails;

- Providing short and meaningful surveys;

- Offering incentives such as entry to contests and sweepstakes;

Additionally, you can gather customer feedback from analytics tools as well. Data collected from analytics is critical to enhancing customer support.

Pro Tip: Juphy‘s review platform integrations will help you to track and manage feedback. And with social inbox, you can receive and respond to real-time feedback from all relevant channels.

Juphy – Recipe for Great Customer Service

Juphy is a highly recommended, top-rated, and powerful social customer service management tool that you should have in your social media customer service arsenal.

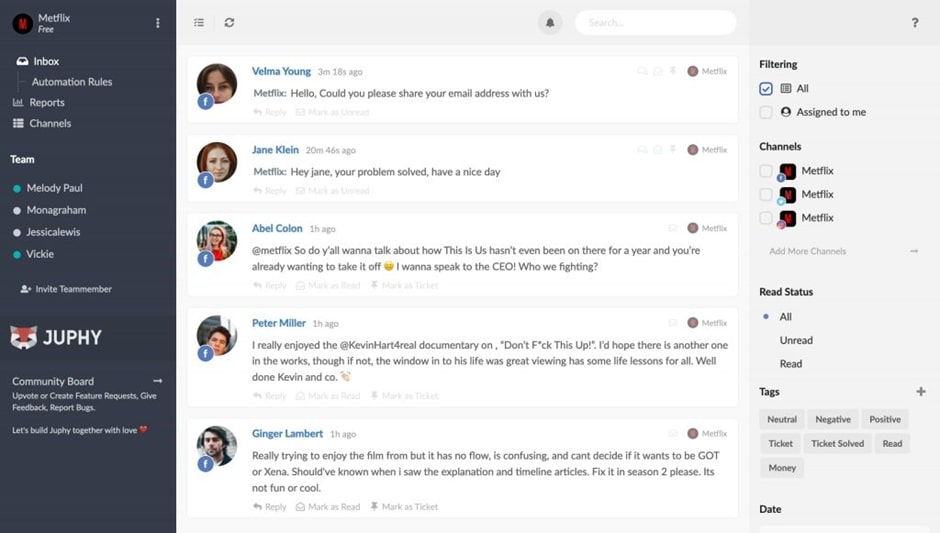

Juphy is integrated with several leading platforms, including

- Instagram: Direct Messages, Comments, Ads Comments

- Facebook: Facebook Groups Comments, Pages Comments, Facebook Messenger, Ads Comments

- Twitter: Tweets and Mentions

- LinkedIn Business: Comments

- YouTube: Comments

Juphy significantly focuses on customer support with the right tools and customer-focused features that set your team up to attend to customers easily and quickly, boosting customer satisfaction and retention in the long run.

Juphy offers:

- An advanced social inbox that helps your customer support team manage all your customer queries, including reviews, and interactions from all the social media platforms you need.

- Juphy’s collaboration tool helps the team to be consistent on all channels and helps keep customer service reps on the same procedural page. It also improves customer support performance and productivity.

- Rather than repeatedly typing out the same information, create pre-defined responses with Juphy. This reduces response time, improves productivity, and enhances job performance.

- Automation helps to classify incoming messages based on sentiment or keywords.

- Tagging and classifying queries automatically according to keywords or sentiments so that no negative reviews go unattended

- Actionable reports help to track the overall performance through different channels, with reporting tools that can help you see and act upon the big picture.

- Review platform integrations with Google My Business, App Store, and Play Store make gathering and acting upon customer feedback easier.

Wrapping Up

Consumers judge companies on factors like ease of engagement, responsiveness, empathy, and transparency. It is high time that FinTech companies must make customer service a universal practice and commitment instead of the hit-and-miss proposition.

Implementing and excelling in these strategies will help your FinTech company acquire new customers and grow relationships.

Falling short in any of these areas can result in diminished trust and loyalty or the loss of a long-tenured connection.

By combining the power of a solid customer strategy and a robust social media customer service tool like Juphy, your FinTech company can provide services that meet consumers’ evolving expectations and demands and deliver premium financial customer service.

Try Juphy’s 7-day free trial, and see how quickly it complements your customer service strategy and improves your FinTech company’s customer service.

FAQ

Some of the features of the FinTech support services are:

* They act as an intermediary between advisors and customers;

* They are customer-oriented;

* They aim to make financial services as comfortable as possible for customers;

* Provide customers with a satisfying customer experience;

* They remove the burden of having to meet a financial advisor in person;

* They can be available 24/7

* Provide banks with customer feedback and analytics. Such data is valuable for financial institutions as it gives them insight into what can be improved.

Here’s how you can add a human touch to your social media responses.

* Use the customer’s name

* Reply with a positive tone

* Show empathy and apologize when necessary

* Close replies with the agent’s name or initials rather than your company name

Customer feedback is vital for FinTech companies because:

* It points out what aspects of your product/services need improvement

* It makes customers feel heard, involved, and valued.

* It generates personal recommendations

* It helps to convince customers to come back for more

* It helps to acquire new customers

* It helps you to build brand loyalty

* Negative feedback can be seen as a chance to improve the product

Some of the key benefits of customer self-service are:

Reduced costs: Self-service enables large-scale customer support at a reduced price and helps banks reduce the number of customer service teams.

Round-the-clock support: Fintech customer service offers 24/7 support, and customers can access self-service anytime, giving them the flexibility they require.

More productive customer support staff: Most customer issue tickets raised are repetitive. Self-service alleviates the support team by reducing the number of repetitive tickets in the queue.

Increased sales and revenue: Customer satisfaction is improved when clients solve most of their issues via self-service. And happier customers are more likely to do more transactions and increase sales and revenue.

Related Article – Which Parts of Customer Service Should Not Be Automated?

Where should businesses draw the line when using automated customer service? This article helps you find the sweet spot for the best results. Read now!